All sales of Dunns Building Supplies (DBS) are made on credit. Sales ar billed twice monthly, on

Question:

All sales of Dunn’s Building Supplies (DBS) are made on

credit. Sales aré billed twice monthly, on the tenth of the month for the last half

of the prior month’s sales and on the 20th of the month for the first half of the

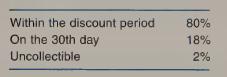

current month’s sales. The terms of all sales are 2/10, net 30. Based on past experience,

the collection experience of accounts receivable is as follows:

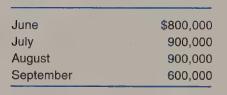

The sales value of shipments for May 2007 was $750,000. The forecast sales

for the next four months are

DBS’s average markup on its products is 20 percent of the sales price.

DBS purchases merchandise for resale to meet the current month’s sales

demand and to maintain a desired monthly ending inventory of 25 percent of the

next month’s sales. All purchases are on credit with terms of net 30. DBS pays

for one-half of a month’s purchases in the month of purchase and the other half

in the month following the purchase.

All sales and purchases occur uniformly throughout the month.

1. How much cash can DBS plan to collect from accounts receivable collections

during July 2007?

2. How much can DBS plan to collect in September from sales made in

August 2007?

3. Compute the budgeted dollar value of DBS’s inventory on August

217 200.76

4. How much merchandise should DBS plan to purchase during June 2007?

5. How much should DBS budget in August 2007 for the payment of

merchandise?

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas