Amsterdam Gardens Hotel Amsterdam Gardens Hotel has 125 hotel rooms. This cozy family hotel has always been

Question:

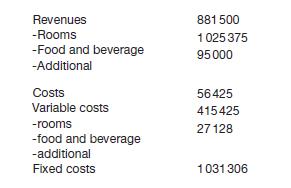

Amsterdam Gardens Hotel Amsterdam Gardens Hotel has 125 hotel rooms. This cozy family hotel has always been a very profitable hotel, due to its nice location on the outskirts of Amsterdam near the beautiful Amstel river, its spacious gardens, and its fine dining opportunities. This historically successful track record, however, stopped two years ago where its occupancy rate was only approximately 57% (26 006 hotel rooms a year). To calculate a profit and loss statement, and to make projections for next year, the hotel controller prepared the following figures for the hotel revenues, variable and fixed costs. Two years ago, the hotel had the following figures:

Required:

1. Compute the contribution margin (total and per hotel room) and the net income before tax using the data given.

Although demand for hotel rooms already decreased last year, next year especially will be a very uncertain year for Amsterdam Gardens. In answering the following questions assume that the costs above are similar to the costs next year.

2. How many rooms should the hotel rent next year to break even?

Since it is unclear how long the current crisis will prolong, a lot of uncertainty exists around the number of hotel rooms that can be rented. When the crisis deepens, occupancy rates will decrease even further, but when the crisis ends the hotel management assumes that the number of rooms rented will go up. Based on this information it expects that the rooms rented follows a normal distribution with an average of 26 006 (last years sales) and a standard deviation of 3000 rooms.

3. What is the probability that the hotel indeed will break even this year?

4. To satisfy its wealthy family members that invest in the hotel, net income needs to go up to €500 000. What is the probability that this income level will be reached?

In explaining to the investors what the probabilities are that the hotel makes a profit of €500 000, one of the investors is arguing that the calculations are overly optimistic because the level of uncertainty is much higher. He orders the management to come up with the same computations but with a standard deviation for the expected number of hotel rooms rented of 4000 instead of 3000.

5. What is the new probability of the profit of €500 000 when the standard deviation increases?

In the computations above, hotel management is assuming that uncertainty in demand will be normally distributed. It therefore assumes that the level of uncertainty is symmetric for decreases and increases in future rooms rented.

6. Do you think this is a realistic assumption? What could be an alternative for this normal distribution (no computations required)?

At the start of the year, the hotel owners considered the plan to outsource the restaurant facility to a third party. This would make the hotel less dependent on the variation in demand. This strategy would severely change the revenue and cost structure. By outsourcing the restaurant facility it would receive €500 000 from the third party, the restaurant would have no variable costs for food and beverage, and be able reduce the fixed costs by €200 000.

7. What is the impact on the probability to break even and to gain a profit of €500 000?

Assume the standard deviation is still €3000.

8. In general, what is the impact of reducing fixed costs in the face of uncertainty?

Step by Step Answer: