Budgeted leverage ratio and scenario analysis AbbaDabba Company has a leverage ratio covenant attached to its line

Question:

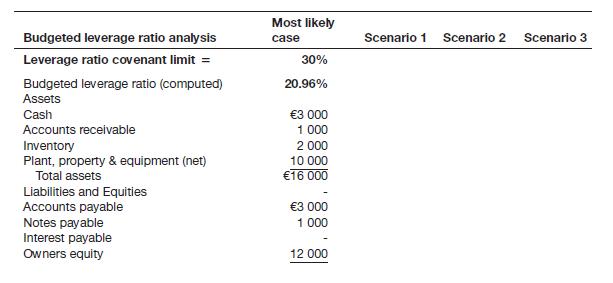

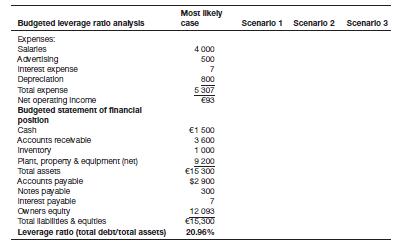

Budgeted leverage ratio and scenario analysis AbbaDabba Company has a leverage ratio covenant attached to its line of credit (e.g. notes payable). For this contract, the leverage ratio is defined as total debt divided by total assets.

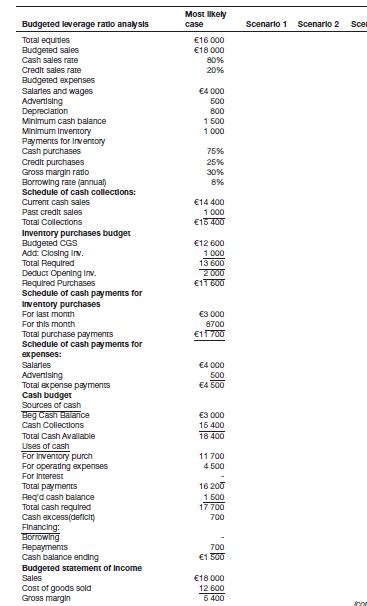

AbbaDabba’s leverage ratio may not exceed 30% at the end of any year or it faces cancellation or restructuring of the terms of its line of credit. The following annual budget model reflects the most likely case for the coming year.

Required:

1. Modify AbbaDabba’s budget model for each of the following scenarios (keep other parameters at the most likely levels):

Scenario 1:Budgeted sales = :15,000, Cash sales rate = 70%, Gross margin ratio = 25%, Borrowing rate = 8%.

Scenario 2:Budgeted sales = :20,000, Cash sales rate = 90%, Gross margin ratio = 40%, Borrowing rate = 6%.

Scenario 3:Cash sales rate = 70%, Budgeted salaries and wages €5,000, Advertising = :700, Minimum cash balance = :2,000, Minimum inventory = :1,500.

2. Comment on the scenario analysis evidence for the risks of AbbaDabba’s violating the leverage ratio covenant.

Step by Step Answer: