Burger-Rama Enterprises runs a chain of drive-in hamburger stands at a tourist attraction during the ten-week summer

Question:

Burger-Rama Enterprises runs a chain of drive-in hamburger stands at a tourist attraction during the ten-week summer season. Managers of all stands are told to act as if they owned the stand and are judged on their profit performance. Burger-Rama Enterprises has rented an ice-cream machine for the summer to supply its stands with ice cream. Rent for the machine is $1,800.

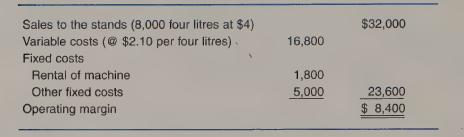

Burger-Rama is not allowed to sell ice cream to other dealers because it cannot obtain a dairy licence. The manager of the ice-cream machine charges the stands $4 per four litres. Operating figures for the machine for the summer are as follows:

The manager of the Sizzling Drive-In, one of the Burger-Rama drive-ins, is seeking permission to sign a contract to buy ice cream from an outside supplier at $3.30 for four litres. The Sizzling Drive-In uses 1,500 four litres of ice cream during the summer. Linda Garton, controller of Burger-Rama, refers this request to you. You determine that the other fixed costs of operating the machine will decrease by $480 if the Sizzling Drive-In purchases from an outside supplier.

Garton wants an analysis of the request in terms of overall company objectives and an explanation of your conclusion. What is the appropriate transfer price?

The Antonio Company uses the decentralized form of organizational structure and considers each of its divisions as an investment centre. Division L is currently selling 15,000 air filters annually, although it has sufficient productive capacity to produce 21,000 units per year. Variable manufacturing costs amount to $17 per unit, while the total fixed costs amount to $90,000. These 15,000 air filters are sold to outside customers at $37 per unit.

Division M, also part of the Antonio Company, has indicated that it would like to buy 1,500 air filters from Division L, but at a price of $36 per unit. This is the price that Division M is currently paying an outside supplier.

1. Compute the effect on the operating income of the company as a whole if Division M purchases 1,500 air filters from Division L.

2. What is the minimum price that Division L should be willing to accept for the air filters?

3. What is the maximum price that Division M should be willing to pay for the air filters?

4. Suppose instead that Division L is currently producing and selling 21,000 air filters annually to outside customers. What is the effect on the overall Antonio Company operating income if Division L is required by top management to sell 1,500 air filters to Division M at (a)

$17 per unit, and (b) $37 per unit?

5. For this question only, assume that Division L is currently earning an annual operating income of $36,000, and the division’s average invested capital is $300,000. The division manager has an opportunity to invest in a proposal that will require an additional investment of

$20,000 and will increase annual operating income by $2,200. (a)

Should the division manager accept this proposal if the Antonio Company uses ROI in evaluating the performance of its divisional managers? (b) If the company uses residual income? (Assume an

“imputed interest” charge of 9 percent.)

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas