Calculation of NPV and ROI and a discussion as to whether goal congruence exists plus a further

Question:

Calculation of NPV and ROI and a discussion as to whether goal congruence exists plus a further discussion relating to resolving the conflict between decision-making and performance evaluation models J plc's business is organized into divisions. For operating purposes, each division is regarded as an investment centre, with divisional managers enjoy- ing substantial autonomy in their selection of investment projects. Divisional managers are rewarded via a remuneration package which is linked to a Return on Investment (ROI) perfor- mance measure. The ROI calculation is based on the net book value of assets at the beginning of the year. Although there is a high degree of autonomy in investment selection, approval to go ahead has to be obtained from group management at the head office in order to release the finance. Division X is currently investigating three inde- pendent investment proposals. If they appear acceptable, it wishes to assign each a priority in the event that funds may not be available to cover all three. Group finance staff assess the cost of capital to the company at 15%.

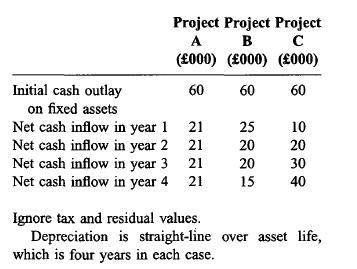

The details of the three proposals are:

You are required

(a) to give an appraisal of the three investment proposals from a divisional and from a company point of view; (13 marks)

(b) to explain any divergence between these two points of view and to demonstrate techniques by which the views of both the division and the company can be brought into line.

Step by Step Answer: