Capital budgeting and inflation Inflation is a general increase in the price level. For example, if the

Question:

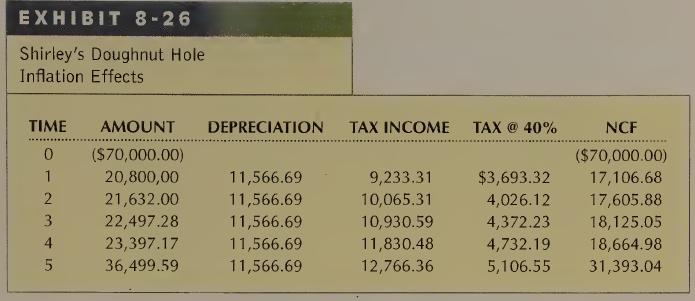

Capital budgeting and inflation Inflation is a general increase in the price level. For example, if the annual cash flows and salvage value in Exhibit 8-17 were subject to inflation at the annual rate of 4%, the cash flows would be those shown in Exhibit 8-26. (Note that, under these conditions, the annual deprecia¬ tion is now $1 1,566 [($70,000 — $12,167) 5].)

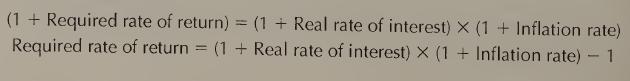

However, with inflation, the required rate of return must be increased so that it will provide for both the time value of money and the purchasing power loss due to inflation. In general, the required rate of return is this:

Required rate of return = Real rate of interest + Inflation rate + Real rate of interest × Inflation rate where the real rate of interest is the return required in the absence of inflation.

(a) Using the appropriate required return, compute the project's net present value.

(b) Why is the net present value of the project lower under conditions of infla¬ tion than it was without inflation?(LO 1)

Step by Step Answer:

Management Accounting

ISBN: 9780130101952

3rd Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, S. Mark Young, Rajiv D. Banker, Pajiv D. Banker