CVP model and time to break-even Larsen Building Co. owns land in an urban area that is

Question:

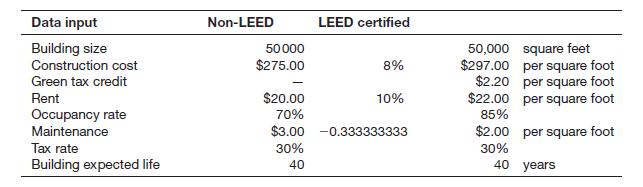

CVP model and time to break-even Larsen Building Co. owns land in an urban area that is zoned for commercial use. Larsen plans to construct and rent a 50 000 square foot commercial building on the site. Larsen is considering whether to design a building that meets criteria for LEED platinum certification

(http://www.usgbc.org), which has marketing and sustainability advantages in the current commercial real estate market. Larsen expects normal construction to meet local needs and buildings codes will cost $275 per square foot. Because of the urban location, meeting the LEED platinum certification is expected to add 8% to construction costs.

However, if the commercial building is successfully certified, Larsen can qualify for a one time, combined federal and state ‘green’ tax credit of $2.20 per square foot. Uncertified commercial property in the vicinity rents typically for $20 per square foot per month, but, because renters can market their ‘green-ness’ and more easily pay for utilities, the occupancy rate for LEED certified properties can increase from 70% to 85%, despite rents that are 10% higher.

Annual maintenance costs for non-certified buildings in the area average $3.00 per square foot, while the cost to maintain LEED buildings can be 1/3 less costly. Larsen's effective tax rate is 30%. The building ’s expected life is 40 years with no salvage value. Ignore other expenses and the time value of money.

Required:

1. What qualitative factors should Larsen Building Co. consider before deciding whether to seek LEED certification?

2. Prepare a financial model to answer the question whether it is worthwhile building to the LEED certification or not.

Step by Step Answer: