Discussion of alternative investment appraisal techniques and the calculation of payback and NPV for two mutually exclusive

Question:

Discussion of alternative investment appraisal techniques and the calculation of payback and NPV for two mutually exclusive projects

(a) Explain why Net Present Value is considered technically superior to Payback and Account- ing Rate of Return as an investment appraisal technique even though the latter are said to be easier to understand by management. High- light the strengths of the Net Present Value method and the weaknesses of the other two methods. (8 marks)

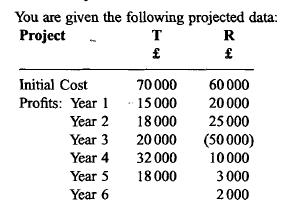

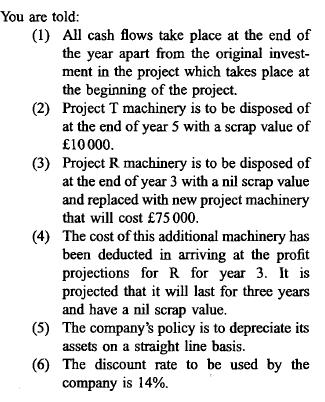

(b) Your company has the option to invest in projects T and R but finance is only available to invest in one of them.

Required: (i) If investment was to be made in project R determine whether the machinery should be replaced at the end of year 3. (4 marks) (ii) Calculate for projects T and R, taking into consideration your decision in (i) above:

(a) Payback period

(b) Net present value and advise which project should be invested in, stating your reasons. (10 marks)

(c) Explain what the discount rate of 14% rep- resents and state two ways how it might have been arrived at. (3 marks)

Step by Step Answer: