Dralin Distribution Co is considering an investment of $$ 460,000$ in a non-current asset expected to generate

Question:

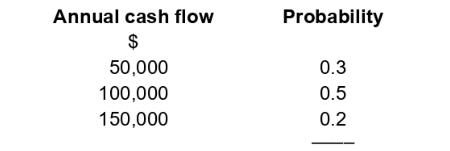

Dralin Distribution Co is considering an investment of $\$ 460,000$ in a non-current asset expected to generate substantial cash inflows over the next five years. Unfortunately, the annual cash flows from this investment are uncertain, but the following probability distribution has been established:

At the end of its five-year life, the asset is expected to sell for $\$ 40,000$. The cost of capital is $5 \%$.

Calculate whether the investment should be undertaken.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: