During a board meeting, the management of Oxiflite Networks Ltd assesses various risks and uncertainties involved in

Question:

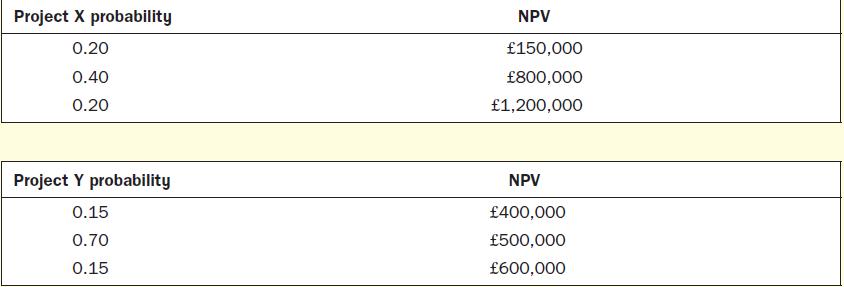

During a board meeting, the management of Oxiflite Networks Ltd assesses various risks and uncertainties involved in its capital investments for the current year. Because of high volatility in the market, it has become a daunting task for the management to perform risk analysis. The CFO, who also serves as a board member, finds it irrational to invest in future projects because of the uncertainty in the market. The other board members have decided to present rational data to convince the CFO to invest in projects. Oxiflite Networks is considering Project X and Project Y in the current year. The following information regarding Project X and Project Y is given:

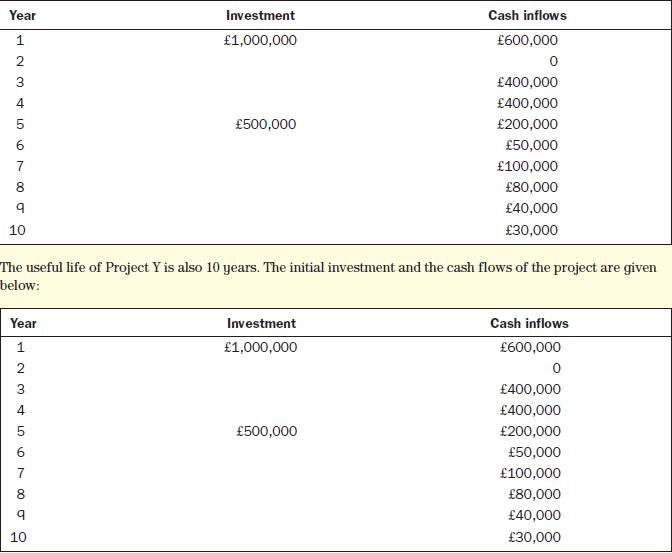

The useful life of Project X is 10 years. The initial investment and the cash flows of the project are given below:

Oxiflite Networks requires a maximum payback of six years.

Required

1. Determine the mean net present value (NPV) of Project X and Project Y. Also, suggest which project the company should choose:

(a) when the risk taken is not considered

(b) when the risk taken is considered.

2. Explain the three attitudes to risk-taking and identify the risk attitude that best describes the CFO of Oxiflite Networks.

3. Calculate the payback period of Project X. Identify if Project X is acceptable.

4. Calculate the payback period of Project Y. Identify if Project Y is acceptable.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen