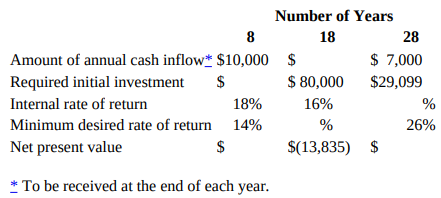

Fill in the blanks. Number of Years 28 18 $ 7,000 Amount of annual cash inflow* $10,000

Question:

Fill in the blanks.

Transcribed Image Text:

Number of Years 28 18 $ 7,000 Amount of annual cash inflow* $10,000 $ $ 80,000 Required initial investment $29,099 Internal rate of return 18% 16% Minimum desired rate of return 14% 26% $(13,835) $ Net present value * To be received at the end of each year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (20 reviews)

This basic exercise develops comfort with the tables and the two major DC...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu

Question Posted:

Related Video

Internal rate of return is a method of calculating an investment’s rate of return. The term internal refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk.

Students also viewed these Business questions

-

Study Exhibit 10-2. Suppose the annual cash inflow will be $2,500 rather than $2,000. What is the internal rate of return? Exhibit 10-2 Oniginal investment, $6,075. Useful lif,for yar. Anual csh...

-

Steve Hammer started his contracting business, Hammer Contractors (HC), six years ago and now owns three machines: a bulldozer, an excavator, and a front-end loader. His business is primarily...

-

Is budgeting used primarily for scorekeeping, attention directing, or problem solving?

-

On June 15, 2020, Smithson Foods purchased $1,000,000 of 2.5 percent corporate bonds at par and designated them as availableforsale investments. On December 31, 2020, Smithsons yearend, the bonds are...

-

Calculate the equivalent inductance Leq of two ideal inductors, L1 and L2, connected in series in a circuit. Assume that their mutual inductance is negligible.

-

Problems 3443. The purpose of these problems is to keep the material fresh in your mind so that you are better prepared for later sections, a final exam, or subsequent courses such as calculus. Find...

-

Why is it useful to compute inventory turnover and the days sales in receivables? How is each of these measures computed? LO.1

-

For the Cobb-Douglas production function in Problem 6.7, it can be shown (using calculus) that MPK = aKa-1 Lb MPL = bKa Lb-1 If the Cobb-Douglas exhibits constant returns to scale (a b 1), show...

-

Can I afford this home? - Part 1 Can Eric and Ginny afford this home using the monthly income loan criterion? Next week, your friends Eric and Ginny want to apply to the Third Universal Bank for a...

-

Data analysis, manufacturing statement, cost terminologyOReilly Manufacturing, Inc.s cost of goods sold for the month ended July 31 was $345,000. The ending work in process inventory was 90% of the...

-

Sallys Subs is considering a proposal to invest in a speaker system that would allow its employees to service drive-through customers. The cost of the system (including installation of special...

-

Assume that new equipment will cost $100,000 in cash and that the old machine cost $84,000 and can be sold now for $16,000 cash. Annual cash savings of $15,000 are expected for 10 years. 1. Compute...

-

Suppose you wanted to know if men or women students spend more money on clothes. You consider two different plans for carrying out an observational study: Plan 1: Ask the participants how much they...

-

What sutra is used to verify BODMAS principle in Vedic Mathematics?Explain in brief.

-

What Is Accounting? Definition, Types, History, & Examples

-

How Does Accounting Work?

-

What Are the Types of Accounting Practices?

-

The Accounting ProfessionWhat Does an Accountant Do?

-

Problem refer to the function F in the graph shown. Use the graph to determine whether F'(x) exists at each indicated value of x. x = a F(x) a b c d e f 8 h

-

Why is the national security argument for tariffs questionable?

-

White Company produces men's shorts and uses the FIFO method to account for its manufacturing costs. The product White makes passes through two processes: cutting and sewing. During May, White's...

-

Watson Company has a product that passes through two processes: grinding and polishing. During October, the grinding department transferred 20,000 units to the polishing department. The cost of the...

-

Using the same data found in Exercise 6-12, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of October.

-

Accounting changes fall into one of three categories. Identify and explain these categories and give an example of each one.

-

Machinery is purchased on May 15, 2015 for $120,000 with a $10,000 salvage value and a five year life. The half year convention is followed. What method of depreciation will give the highest amount...

-

Flint Corporation was organized on January 1, 2020. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 514,000 shares of no-par common stock with a stated value of $2...

Study smarter with the SolutionInn App