Flexiplite Technologies Ltd has been doing extremely well in terms of revenue in its domestic market and

Question:

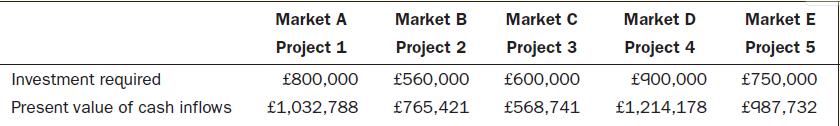

Flexiplite Technologies Ltd has been doing extremely well in terms of revenue in its domestic market and is now considering setting up a manufacturing unit outside the country. The technology industry is subject to stiff market competition and supply–demand uncertainties. It is imperative that the company evaluates various aspects of the capital investment decision. Capital investment in other countries can involve additional risks, such as exchange rate risk and political risk. After analysing various external and internal factors, management has decided to look for investment projects in five markets that could offer a good return. Management decides to assess the investment opportunities in these markets with the help of screening decisions. However, the company’s accountants have suggested that a capital budgeting technique, which recognizes the time value of money, should be used to check the viability of the projects. The following investment proposals were submitted by project evaluators from each of the five markets:

Management is reluctant to proceed with the investment because of ingrained risk. However, the accountants are confident that they will reap good returns from the investment. At present, the company uses a discount rate of 10% for all its capital investments. However, management is uncertain if the same required rate of return must be retained for future projects.

Required

1. The accountants at Flexiplite Technologies have suggested that the company should use the discounted cash flow method of capital budgeting. Based on the suggestions provided by the accountants, which capital budgeting techniques should be used by Flexiplite to check the viability of its projects?

2. Management is apprehensive about proceeding with the investment because of the risk involved. What would indicate that low risk is involved in the investment?

3. The company decides to set up a manufacturing unit in Market C. Calculate the net present value from Project 3.

4. Calculate the profitability index from Project 2.

5. Determine which project or market ranks the highest using the profitability index as a tool?

6. The management of Flexiplite Technologies has decided to assess investment opportunities using screening tools. What operates as a screening tool?

7. The accountants at Flexiplite Technologies suggest that one way of dealing with risk is to acquire more information. Discuss the value of extra information.

8. If a decision to be taken by Flexiplite Technologies Ltd depends on a sequence of linked risky states, then what technique should it use?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen