Ford Motor Co. had been outsourcing production to Mazda and using overtime for as much as 20

Question:

Ford Motor Co.

had been outsourcing production to Mazda and using overtime for as much as 20 percent of production—Ford’s plants and assembly lines were running at 100 percent of capacity and demand was sufficient for an additional 20 percent.

Ford had considered building new highly automated assembly lines and plants to earn more profits since overtime premiums and outsourcing were costly.

However, the investment in high technology and capacity expansion was rejected.

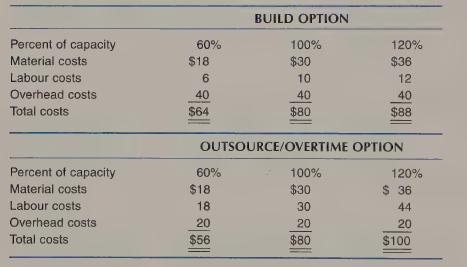

Assume that all material and labour costs are variable with respect to the level of production and that all overhead costs are fixed. Consider one of the plants that makes Ford Probes. The cost to convert the plant to use fully automated assembly lines is $20 million. The resulting labour costs would be significantly reduced. The costs, in millions of dollars, of the build option and the outsource/overtime option are given in the table below.

1. Prepare a line-graph showing total costs for the two options: build new assembly lines, and continue to use overtime and outsource production of Probes. Give an explanation of the cost behaviour of the two options.

2. Which option enables Ford management to control risk better?

Explain. Assess the cost/benefit associated with each option.

3. A solid understanding of cost behaviour is an important prerequisite to effective managerial control of costs. Suppose you are an executive at Ford and currently the production (and sales) level is approaching the 100 percent level of capacity and the economy is expected to remain strong for at least one year. While sales and profits are good now, you are aware of the cyclical nature of the automobile business. Would you recommend committing Ford to building automated assembly lines in order to service potential near-term increases in demand or would you recommend against building, looking to the likely future downturn in business? Discuss your reasoning.

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas