Form groups of four persons each. Each person should select one of the following four roles (if

Question:

Form groups of four persons each. Each person should select one of the following four roles (if groups have between four and eight persons, two persons can play any of the roles in the exercise):

Bernard Schwartz, President Ramona Sanchez, Controller Leonard Swanson, Marketing Manager Kate Cheung, Treasurer Each of the four should prepare a justification for the type of financial statements, variable or absorption costing, that he or she favours. The setting is explained in the case “Boylston Company” that follows.

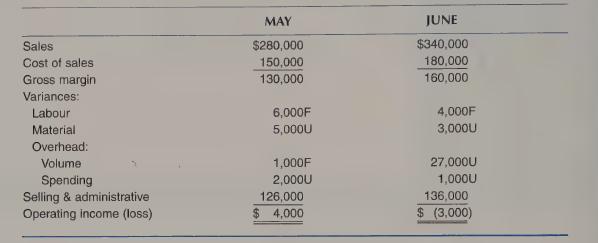

Bernard Schwartz took over as president of Boylston Company in mid-May, 2006. The company’s operating income for May was $4,000, and Schwartz was determined that June would be a better month. But when he received the following income statements for May and June, he was shocked:

He called Ramona Sanchez, the company’s controller, and asked, “Sales were up by $60,000 in June. How could operating income possibly have decreased by $7,000? There must be something wrong with your numbers.”

Sanchez replied, “The numbers are right. I agree with you they don’t make sense, but since our production was down in June, operating income suffered.”

Schwartz wasn’t satisfied with that explanation. “If your accounting numbers don’t give a good signal about performance, what good are they?”

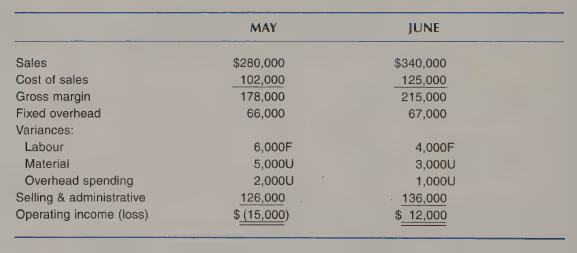

Sanchez had anticipated this reaction. She suggested charging the fixed manufacturing costs as a period cost instead of including them in the product cost. Her reworked income statement was as follows:

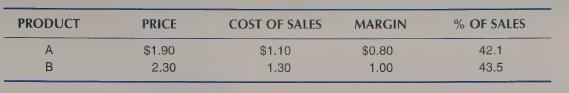

Sanchez also called on Leonard Swanson, the marketing manager, to support her new statements. Swanson pointed out that the current accounting system did not provide the right incentives to his sales force. For example, he pointed to two products, A and B, with the following prices and costs:

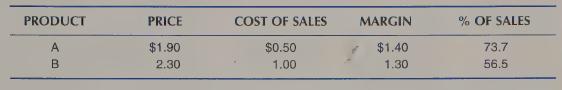

The sales force would be inclined to focus on Product B because of its higher margin as a percent of sales. However, he believed the following figures, based on the controller’s new product costs, was a better measure of the relative profitability of the products:

After some discussion, Schwartz brought in Kate Cheung, corporate treasurer, who was sceptical about the new system. She maintained that “the sales force will start cutting prices if we leave fixed costs out of our product costs. They will try for the same margin over the reduced costs, and we will not be able to cover our fixed costs. Further, it’s lack of control of long-run costs, not short-run variable costs that can destroy a company. In the short run, things constantly change and we don’t make much of a commitment. But if long-run costs get out of control, there isn’t much we can do about it.”

Cheung was not finished. “And what about taxes? The government won't let us use your new system. And what about the balance sheet? Inventories that we now show at about $520,000 would have to be shown at about $365,000 if the fixed costs are not considered product costs. That sure doesn’t make us look better to investors.”

Although Schwartz liked the June profit shown by the revised statements, he thought there was some truth in all of the comments made. He wasn’t sure how to proceed.

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas