GS Ltd has recently decided to enter into a joint venture with Garvs Ltd, with the newly

Question:

GS Ltd has recently decided to enter into a joint venture with Garvs Ltd, with the newly formed company being named ABG Ltd and manufacturing and selling high-end sports clothes in Nordland.

ABG Ltd has been trading for two full accounting periods. The majority of its assets are non-current and comprise plant and machinery. The machinery was acquired two years ago and has not been replaced yet, although this will be done in the next 12 months. The heavy investment demanded more cash than initially expected and so loans were agreed with the bank on a variable rate.

Sales were initially limited to retail partners in Nordland's capital city, although the retail partner base is increasing gradually to other cities. Prices have remained stable, although they may rise in the future to try and increase profitability. The main materials used to make the clothing are imported from a neighbouring country, Exland, and paid for in Euros.

When ABG Ltd was incorporated two years ago, external consultants were used to help set up the production systems in the first year. Having trained the newly employed staff, the consultants' costs could not be justified and so we did not renew their contract. You have been called to a meeting with Joe Froome.

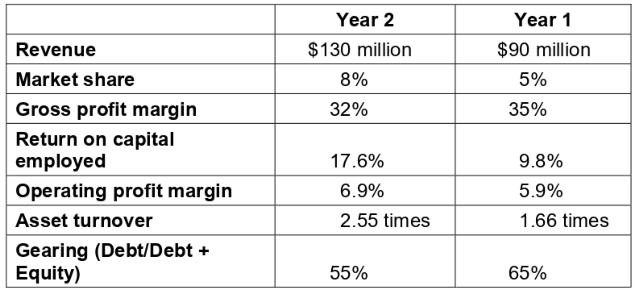

'We have had the first two years' trading results in for ABG Ltd and I have made a copy for you to look at. We are encouraged to see that it is making a profit, however the board thought that after two years the results would be looking better. They would like us to draft a brief report that comments on the financial performance and position to date and suggests what the future could hold for ABG Ltd. Here are some ratios that I have calculated for us to consider but, as I am needed in another meeting, I need you to put the analysis together. I think you will find these extracts from the management commentary about ABG Ltd useful.

Remember that there is more market share to gain as we are starting to notice an increase in competition. As you know, when we first entered the market, we were the only manufacturer in Nordland, but now that we have started to find success there, competitors have also started manufacturing there and selling to the Nordland market.

Please could you review these calculations and provide me with a brief analysis for me to take to the board."

ABG Ltd - financial statements from the first two years of trading:

Step by Step Answer: