In late January 2006, George Ray, president of Restoration Resort Ltd., is concerned about how he could

Question:

In late January 2006, George Ray, president of Restoration Resort Ltd., is concerned about how he could finance the more than $200,000 he estimates he needs to convert, improve, and expand the company’s resort facilities. The resort has very little cash, and George and his wife have about $20,000 in savings. The land on which the resort is located has been in the Ray family for 40 years. The 12-unit motel was constructed 25 years ago. The motel is open year-round. Occupancy of rooms in the peak summer months (mid-June to mid-September) is 100 percent, but a lower occupancy during the shoulder and winter months reduces overall annual occupancy to 60 percent. In the winter months, the rooms are rented on a monthly basis.

About 20 years ago, a swimming pool was added along with a change house, snack bar/souvenir shop, and a 20-space trailer park. The trailer park is only open during the summer months (approximately 150 days), and, during that period, spaces are 90 percent occupied.

Although losses occurred in earlier years, the resort is now reasonably profitable. However, the resort has not until now been considered the main business of the Ray family, since both George (who inherited the resort from his parents 10 years ago) and his wife work at other jobs and look at the resort as a part-time business. It has become increasingly apparent to them that, because of the economic times, they will have to make changes to the resort and work at it full time if it is to remain successful.

After considerable thought and discussion, the Rays decided that the following changes would have to be made to bring the resort up to a standard acceptable to today’s traveling public:

a. Add eight fully furnished 400-square foot cabins with a potential of 32 additional overnight guests.

b. Fill in the pool, which has become badly corroded from minerals in the water. This pool has been fully depreciated.

c. Construct a new 3,300-square-foot swimming pool.

d. Renovate and modernize the combined frame change house and snack bar.

e. Add an extension to the change house that includes shower rooms for trailer park guests and houses the resort’s office.

f. Expand the trailer park area from 20 to 50 stalls and provide electrical and sewer hookup to all stalls.

In addition to the Restoration Resort land, George personally owns land that includes a hill at the back of the property, which has potential for skiing. This piece of land is estimated to be worth about $50,000 at today’s prices. However, George thinks that the investment required to develop it for skiing would not make the project currently feasible, even though it might considerably improve the winter rooms occupancy.

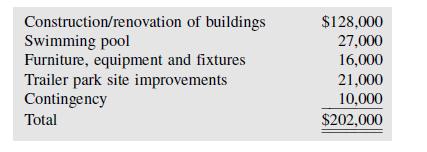

The investment costs for the proposed changes to the property are estimated as follows:

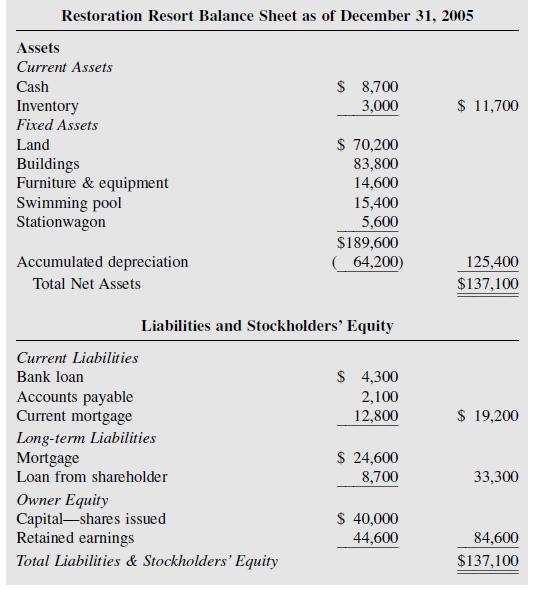

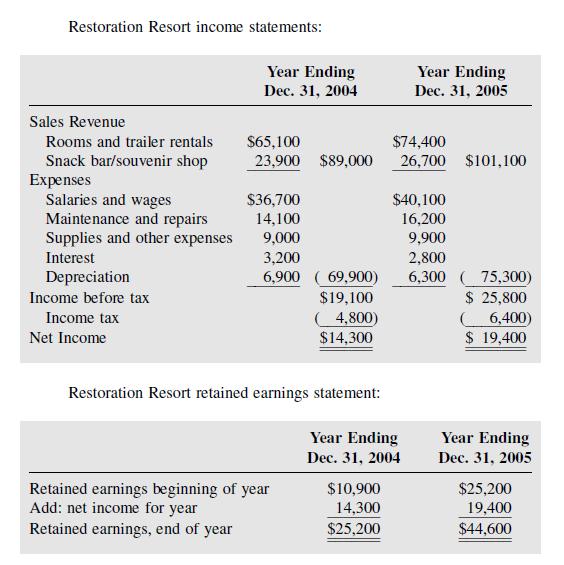

A balance sheet for the year ending December 31, 2005, follows, as do income statements for the years 2004 and 2005.

Revenue for the year 2006 is estimated to be about 5 percent above year 2005, primarily as a result of a price increase, rather than an increase in occupancy. Expenses are estimated in total to be about 5 percent higher than in 2005.

a. Given the balance sheet and income statements, calculate whatever financial ratios (see Chapter 4) you think are appropriate that will indicate the financial health of the Restoration Resort.

b. List the information that you would like to have that is not shown on the financial statements, but would make it easier to carry out some financial projections as a preliminary step before going ahead with a complete feasibility study (see Chapter 13) for expansion.

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471092223

8th Edition

Authors: Martin G Jagels, Michael M Coltman