Itervero Ltd, a small engineering company, operates a job order costing system. It has been invited to

Question:

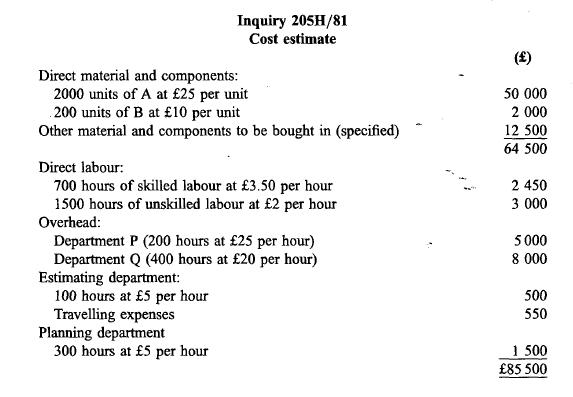

Itervero Ltd, a small engineering company, operates a job order costing system. It has been invited to tender for a comparatively large job which is outside the range of its normal activities and, since there is surplus capacity, the management are keen to quote as low a price as possible. It is decided that the opportunity should be treated in isolation without any regard to the possibility of its leading to further work of a similar nature (although such a possibility does exist). A low price will not have any repercussions on Itervero's regular work. The estimating department has spent 100 hours on work in connection with the quotation and they have incurred travelling expense of 550 in connection with a visit to the prospective customer's factory overseas. The following cost estimate has been prepared on the basis of their study.

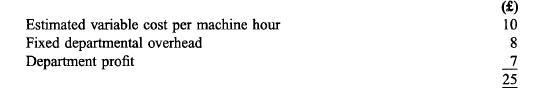

The following information has been brought together: Material A: This is a regular stock item. The stock holding is more than sufficient for this job. The material currently held has an average cost of 25 per unit but the current replacement cost is 20 per unit. Material B: A stock of 4000 units of B is currently held in the stores. This material is slow-moving and the stock is the residue of a batch bought seven years ago at a cost of 10 per unit. B currently costs 24 per unit but the resale value is only 18 per unit. A foreman has pointed out that B could be used as a substitute for another type of regularly used raw material which costs 20 per unit. Direct labour: The workforce is paid on a time basis. The company has adopted a 'no redundancy' policy and this means that skilled workers are frequently moved to jobs which do not make proper use of their skills. The wages included in the cost estimate are for the mix of labour which the job ideally requires. It seems likely, if the job is obtained, that most of the 2200 hours of direct labour will be performed by skilled staff receiving 3.50 per hour. Overhead - Department P: Department P is the one department of Itervero Ltd that is working at full capacity. The department is treated as a profit centre and it uses a transfer price of 25 per hour for charging out its processing time to other departments. This charge is calculated as follows:

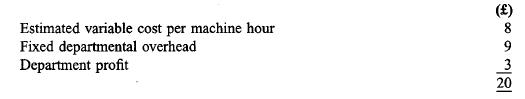

Department P's facilities are frequently hired out to other firms and a charge of 30 per hour is made. There is a steady demand from outside customers for the use of these facilities. Overhead - Department Q: Department Q uses a transfer price of 20 for charging out machine processing time to other departments. This charge is calculated as follows:

Estimating department: The estimating department charges out its time to specific jobs using a rate of 5 per hour. The average wage rate within the department is 2.50 per hour but the higher rate is justified as being necessary to cover departmental overheads and the work done on unsuccessful quotations. Planning department: This department also uses a charging out rate which is intended to cover all department costs.

(a) You are required to restate the cost estimate by using an opportunity cost approach. Make any assumptions that you deem to be necessary and briefly justify each of the figures that you give. (10 marks)

(b) Discuss the relevance of the opportunity cost approach to the situation described in the question and consider the problems which are likely to be encountered if it is used in practice.

(c) Briefly discuss the general applicability of opportunity cost in business decision making where a choice exists among alternative courses of action.

Step by Step Answer: