Muriel Santelli had recently been appointed controller of the breakfast cereals division of a major food company.

Question:

Muriel Santelli had recently been appointed controller of the breakfast cereals division of a major food company.

The division manager, Ram Krishnamurthi, was known as a hard-driving,

intelligent, uncompromising manager. He had been very successful and was rumoured to be on the fast track to corporate top management, maybe even in line for the company presidency. One of Santelli’s first assignments was to prepare the financial analysis for a new cold cereal, Krispie Krinkles. This product was especially important to Krishnamurthi because he was convinced that it would be a success and thereby a springboard for his ascent to top management.

Santelli discussed the product with the food lab that had designed it, with the market research department that had tested it, and with the finance people who would have to fund its introduction. After putting together all the information,

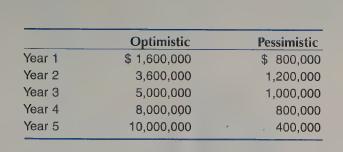

she developed the following optimistic and pessimistic sales projections:

The optimistic predictions assume a successful introduction of a popular product. The pessimistic predictions assume that the product is introduced but does not gain wide acceptance and is terminated after five years. Santelli thinks the most likely results are halfway between the optimistic and pessimistic predictions.

Santelli learned from finance that this type of product introduction requires a predicted rate of return of 16 percent before top management will authorize funds for its introduction. She also determined that the contribution margin should be about 50 percent on the product, but could be as low as 42 percent or as high as 58 percent. Initial investment would include $3 million for production facilities, $2.5 million for advertising and other product introduction expenses,

and $500,000 for working capital (inventory, etc.). The production facilities would have a value of $800,000 after five years.

Based on her preliminary analysis, Santelli recommended to Krishnamurthi that the product not be launched. Krishnamurthi was not pleased with the recommendation.

He claimed that Santelli was much too pessimistic and asked her to redo her numbers so that he could justify the product to top management.

Santelli carried out further analysis, but her predictions came out no different.

In fact, she became even more convinced that her projections were accurate.

Yet, she was certain that if she returned to Krishnamurthi with numbers that did not support introduction of the product, she would incur his wrath. And, in fact,

he could be right—that is, there is so much uncertainty in the forecasts that she could easily come up with believable numbers that would support going forward with the product. She would not believe them, but she believed she could convince top management that they were accurate.

The entire class could role-play this scenario, or it could be done in teams of three to six persons. Here, it is acted out by a team.

Choose one member of the team to be Muriel Santelli and one to be Ram Krishnamurthi.

1. With the help of the entire team except the person chosen to be Krishnamurthi, Santelli should prepare the capital-budgeting analysis used for her first meeting with Krishnamurthi.

2. Next, Santelli should meet again with Krishnamurthi. They should try to agree on the analysis to take forward to top management. As they discuss the issues and try to come to an agreement, the remaining team members should record all the ethical judgments each discussant makes.

3. After Santelli and Krishnamurthi have completed their role-playing assignment, the entire team should assess the ethical judgments made by each and recommend an appropriate position for Santelli to take in this situation.

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas