Net present value and profitability index Lebar Company is considering two mutually exclusive investment alternatives. Lebar has

Question:

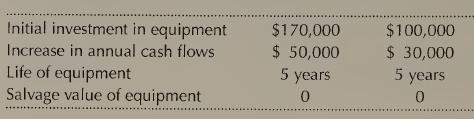

Net present value and profitability index Lebar Company is considering two mutually exclusive investment alternatives. Lebar has a 10% cost of capital. Cash flow information for the two alternatives appears below.

(a) Compute the net present value for each alternative and determine which al¬ ternative is more desirable using the net present value criterion.

(b) Compute the profitability index for each alternative and determine which al¬ ternative is more desirable using the profitability index criterion.

(c) Why do the rankings differ under the two alternatives? Which alternative would you recommend?(LO 1)

Step by Step Answer:

Management Accounting

ISBN: 9780130101952

3rd Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, S. Mark Young, Rajiv D. Banker, Pajiv D. Banker