Orinoco Inc. produces and sells wireless reading devices. A competitor, Nile Electronic Products (NEP), sells similar wireless

Question:

Orinoco Inc. produces and sells wireless reading devices. A competitor, Nile Electronic Products (NEP), sells similar wireless reading devices that it purchases at wholesale from Sonex for $97 each. Both sell the devices for $180.

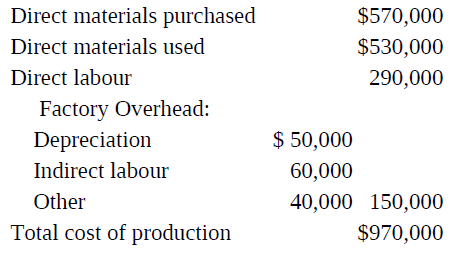

In 2012, Orinoco produced 10,000 devices from Sonex at the following costs:

Assume that Orinoco had no beginning inventory of direct materials. There was no beginning inventory of finished devices, but ending inventory consisted of 1,000 finished devices. Ending work-in-process inventory was negligible.

Each company sold 9,000 devices for $1,620,000 in 2012 and incurred the following selling and administrative costs:

Sales salaries and commissions .........................$105,000

Depreciation on retail store ....................................40,000

Advertising ................................................................25,000

Other .........................................................................15,000

Total selling and administrative cost .................$185,000

1. Prepare the inventories section of the balance sheet for December 31, 2012 for Nile.

2. Prepare the inventories section of the balance sheet for December 31, 2012 for Orinoco.

3. Prepare an income statement for the year 2012 for Nile. Include the following accounts in the cost of goods sold section: Beginning inventory, Purchases, Cost of goods available for sale, Less ending inventory, Cost of goods sold.

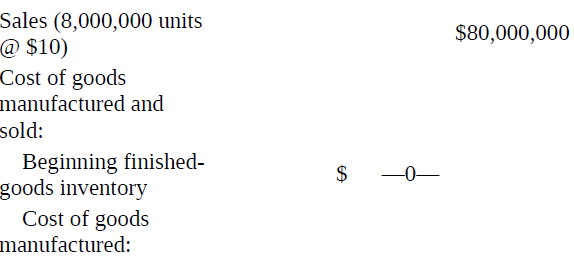

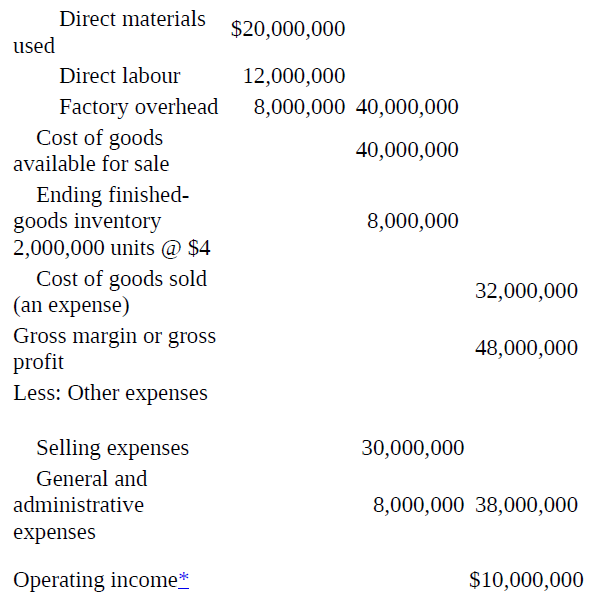

4. Using the cost of goods sold format in Exhibit 4-4 as a model, prepare an income statement for the year 2012 for Orinoco.

5. Summarize the differences between the financial statements of Nile, a merchandiser, and Orinoco, a manufacturer.

6. What purpose of a cost management system is being served by reporting the items in requirements 1 through 4?

Exhibit 4-4

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu