Pizza Restaurant provides a delivery service and is considering purchasing a new compact vehicle or leasing it.

Question:

Pizza Restaurant provides a delivery service and is considering purchasing a new compact vehicle or leasing it. Purchase price would be

$13,500 (cash), which the restaurant has. Estimated life is five years.

Residual (trade-in) value is $2,500.

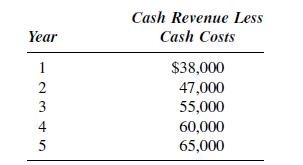

Under the purchase plan, the additional net cash income (increased revenue less additional costs such as vehicle maintenance and driver’s wages) before deducting depreciation and income tax would be as follows:

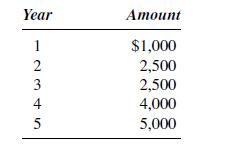

Depreciation will be straight-line. Income tax rate is 30 percent. Under the rental plan the cash income will be the same as under the purchase plan, except that vehicle maintenance will not be required (the leasor pays for this). Therefore, the given net cash income figures will have to be increased by the following maintenance amount savings:

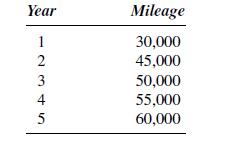

However, under the rental plan, there is a rental cost based on mileage.

Estimated mileage figures follow:

Rental cost is $0.30 per mile. Income tax rate will be 30 percent.

a. On a net present value basis using a 10 percent rate, would it be better to rent or buy?

b. Would your answer change if the rental cost were $1,000 a year plus $0.30 a mile? Explain your decision.

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471092223

8th Edition

Authors: Martin G Jagels, Michael M Coltman