Profit planning and Monte Carlo analysis Pendant Corporation is a local financial services firm that sells home

Question:

Profit planning and Monte Carlo analysis Pendant Corporation is a local financial services firm that sells home mortgages to home owners.

The company has focused on growing its regional market share and managing its profitability.

You are a consultant to Pendant, and your current assignment is to build a profitability model of the company that is driven by key environmental and policy variables. The company identifies interest rate variability as the largest source of financial risk but is also concerned about other possible sources of risk. Accordingly, you have also agreed to analyse the financial risk of the model via Monte Carlo analysis. NOTE: This obviously is a simplified depiction of the mortgage banking business.

Required:

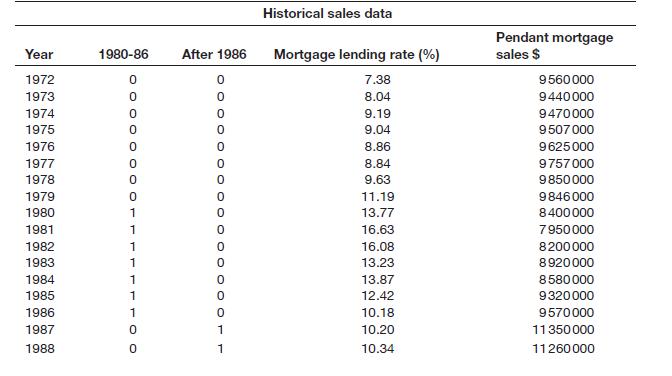

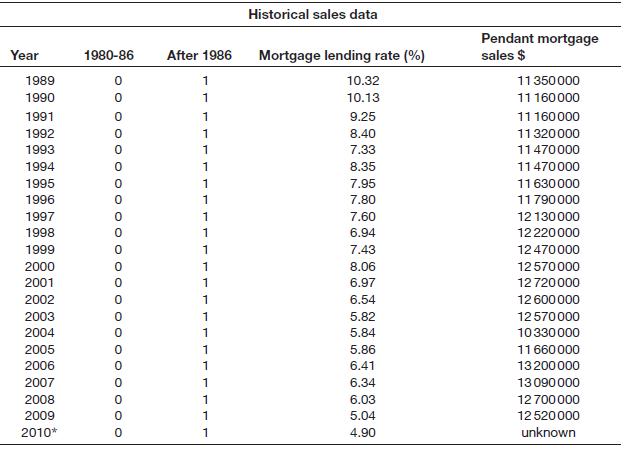

1. Prepare a mortgage sales forecasting model from the following time series annual sales data. Hint: Use multiple regression analysis. The indicator (0,1) variables may pick up shifts in the home lending market. The rate is the annual average 30-year mortgage rate. Mortgage sales is the dollar value of mortgages sold. Use the forecasting model to estimate 2010 mortgage sales.

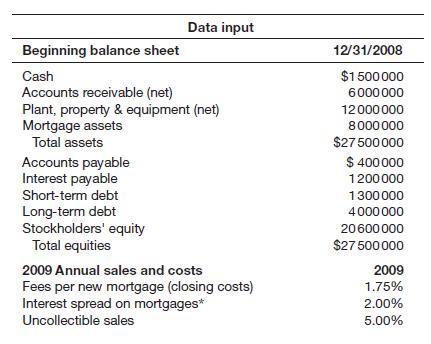

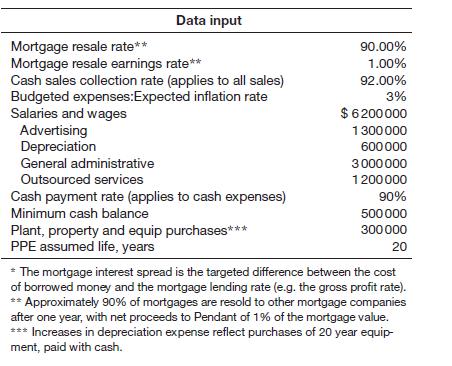

2. Use the results from your regression analysis and the following input data to build a 2009 profit planning model for Pendant Corporation. Pendant earns the difference between its cost of borrowed money to finance the mortgages and the mortgage lending rate it charges homeowners (the ’spread’) on these dollar amounts. For example, if the spread was 2%, Pendant earned on its average 1972 mortgage sales (.0738) * ($9560000/2)

as revenue in 1972 and paid (.0738 - .02) * ($9560000/2) as interest expense. Pendant also earns the lending rate on its mortgage assets.

3. Modify your profit planning model to perform Monte Carlo analysis on expected 2010 profits. Randomise annual mortgage sales using the results of your sales analysis in question 1.

Step by Step Answer: