Profit-sharing plan at Hoechst Celanese Hoechst Celanese, a pharmaceutical manufacturer, has used a profit-sharing plan, the Hoechst

Question:

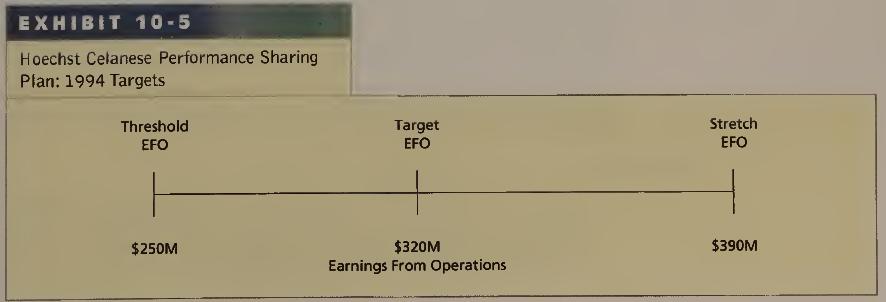

Profit-sharing plan at Hoechst Celanese Hoechst Celanese, a pharmaceutical manufacturer, has used a profit-sharing plan, the Hoechst Celanese Performance Sharing Plan, to motivate employees. To operationalize the plan, the Hoechst Celanese Executive Committee set a target earnings from operations (EFO). This target was based on the company's business plans and the economy's expected performance. The Performance Sharing Plan also used two other critical values: the earnings from operations threshold amount and the earnings from operations stretch target. The targets for 1994 are shown in Exhibit 10-5.

The plan operates as follows. If earnings from operations fall below the threshold value, there is no profit sharing. If earnings from operations lie be¬ tween the threshold amount and the target, the profit-sharing percent is pro¬ rated between the threshold award of 1% and the target payment of 4%. For example, if earnings from operations were $285 million, the profit-sharing percent would be 2.5%.

REQUIRED

(a) List, with explanations, what you think are desirable features of the Hoechst Celanese Performance Sharing Plan.

(b) List, with explanations, what you think are the undesirable features of the Hoechst Celanese Performance Sharing Plan.

(c) The EFO for 1994 was $332 million. Compute the size of the profit-shar¬ ing pool.

(d) In 1995 the Performance Sharing Plan parameters were threshold EFO— $420 million; target EFO—$490 million; and stretch EFO—$560 mil¬ lion. What do you think of the practice of raising the parameters from one year to the next?LO1

Step by Step Answer:

Management Accounting

ISBN: 9780130101952

3rd Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, S. Mark Young, Rajiv D. Banker, Pajiv D. Banker