Relatively unknown is the way in which Pierre du Pont connected the old practice of using financial

Question:

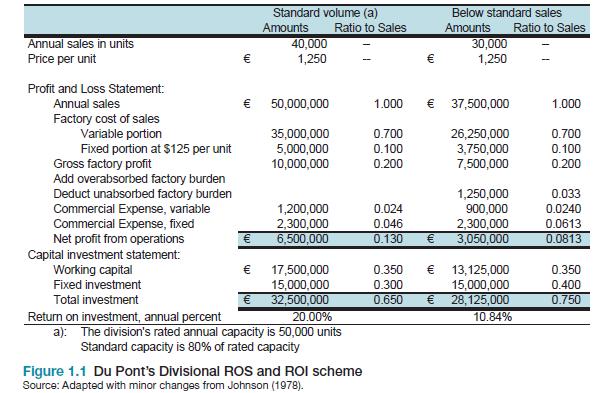

Relatively unknown is the way in which Pierre du Pont connected the old practice of using financial ratios related to sales with the new practice of relating financial measures to the money invested in the business. An example is the following pro forma profit and loss statement based on sales at normal capacity of 40 000 units (see Figure 1.1).

a. How can we calculate the ROI numbers directly from return on sales (ROS) figures? Use the standard volumes.

b. The division turned in their financial report and it appears that they have realised sales of 30 000 units, which is 10 000 below standard (see Figure 1.1, the two righthand columns).

State the reasons why some ROS figures have changed, while other remained the same.

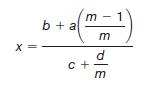

In order to directly calculate the impact of several ROS measures, DuPont had invented the following equation:

In which:

x = return on investment b = the ratio of net profit to sales a = the ratio of fixed factory and commercial costs to sales c = the ratio of working capital to sales d = the ratio of fixed investment to sales m = the ratio of proposed or realised volume to standard volume

c. Explain the working of DuPont's equation.

d. Suppose the division continues to operate on 30 000 units (10 000 below standard volume) and needs to produce a ROI of 20%, what would be a reasonable strategy if we know that fixed costs and capital investments (both in working capital and fixed investments) cannot be changed.

Step by Step Answer: