The cordless phone manufacturing division of a consumer electronics company uses activity-based accounting. For simplicity, assume that

Question:

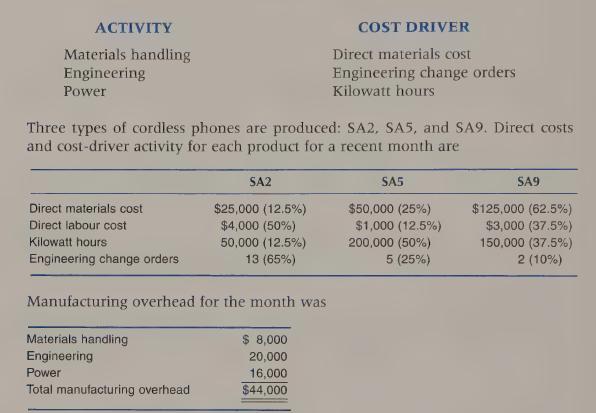

The cordless phone manufacturing division of a consumer electronics company uses activity-based accounting. For simplicity, assume that its accountants have identified only the following three activities and related cost drivers for manufacturing overhead:

1. Compute the manufacturing overhead allocated to each product with the activity-based accounting system.

2. Suppose all manufacturing overhead costs have been allocated to products in proportion to their direct labour costs. Compute the manufacturing overhead allocated to each product.

3. In which product costs—those in requirement 1 or those in requirement 2—do you have the most confidence? Why?

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas