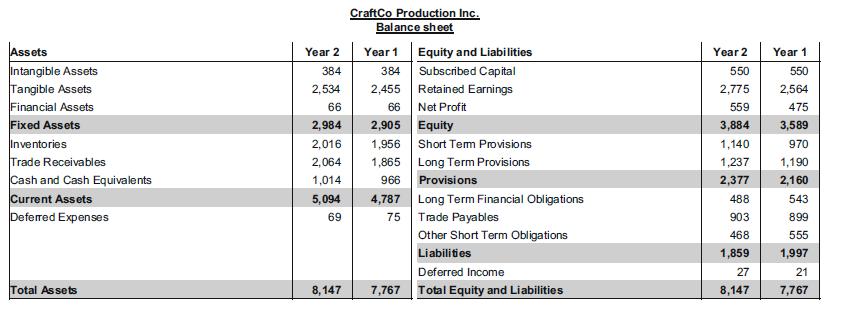

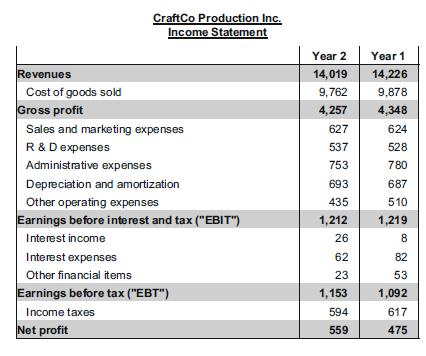

The financial accounting department of CraftCo Production Inc. has provided you with the balance sheet and income

Question:

The financial accounting department of CraftCo Production Inc. has provided you with the balance sheet and income statement figures that present the essential annual financial information. Determine net working capital and the cash-to-cash cycle time for year 2!

Transcribed Image Text:

Assets Intangible Assets Tangible Assets Financial Assets Fixed Assets Inventories Trade Receivables Cash and Cash Equivalents Current Assets Deferred Expenses Total Assets Year 2 384 2,534 66 2,984 2,016 2,064 1,014 5,094 69 8,147 CraftCo Production Inc. Balance sheet Year 1 384 2,455 66 2,905 1,956 1,865 966 4,787 75 7,767 Equity and Liabilities Subscribed Capital Retained Earnings Net Profit Equity Short Term Provisions Long Term Provisions Provisions Long Term Financial Obligations Trade Payables Other Short Term Obligations Liabilities Deferred Income Total Equity and Liabilities Year 2 550 2,775 559 3,884 1,140 1,237 2,377 488 903 468 1,859 27 8,147 Year 1 550 2,564 475 3,589 970 1,190 2,160 543 899 555 1,997 21 7,767

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

To determine the net working capital and the cashtocash cycle time for CraftCo Production Inc for year 2 lets start by calculating the net working cap...View the full answer

Answered By

Saleem Abbas

Have worked in academic writing for an a years as my part-time job.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Management Accounting In Supply Chains

ISBN: 978-3658412999

2nd überarb. U. Erw. Edition

Authors: Andreas Taschner, Michel Charifzadeh

Question Posted:

Students also viewed these Business questions

-

Find the volume of the following solids. One of the wedges formed when the cylinder x + y = 4 is cut by the planes z = 0 and y = z X 2

-

What is the purpose of this component of the grant? What key elements are required in the executive summary?

-

The following information concerns seven US companies operating solely or mainly restaurants. McDonalds Corporation McDonalds Corporation franchises and operates McDonalds restaurants in the food...

-

A small piece of zinc is dissolved in 50.00 mL of 1.035M HCl. At the conclusion of the reaction, the concentration of the 50.00 mL sample is redetermined and found to be 0.812 M HCl. What must have...

-

A 5-oz serving of a Bloody Mary contains 14 g of alcohol and 5 g of carbohydrates, and thus 116 Calories. A 2.5-oz serving of a martini contains 22 g of alcohol and a negligible amount of...

-

Insert the missing words: There are many ways that one can gather the necessary evidence to support the testing objective. The number and types of techniques are limited only by the . . . . . . . . ....

-

An experiment is being performed to test the effects of a new drug on high blood pressure. The experimenter identifies 320 people ages 3550 years old with high blood pressure for participation in the...

-

A fuel gas containing 85.0 mole% methane and the balance ethane is burned completely with pure oxygen at 25C and the products are brought back down to 25C. (a) Suppose the reactor is continuous. Take...

-

The Medicare Part C program: Group of answer choices provides a comprehensive prescription drug benefit. was created to provide health insurance for indigent children who do not qualify for Medicaid....

-

Background: A new ownership group has recently purchased ABC Liquors. You have been hired by the new management team to analyze their sales data for the past year and provide them with insights about...

-

How are physical flows and financial flows linked in a supply chain? Why must a supply chain always combine both types of flows?

-

Explain the conditions for employing ABC in a supply chain network.

-

Ethel Greenberg acquired the ownership of the Carlyle Hotel on Miami Beach. Having had little experience in the hotel business, she asked Miller to participate in and counsel her operation of the...

-

do you agree wih this approach to dismantling the toxic culture? explain

-

Movies When randomly selecting a speaking character in a movie, the probability of getting a female is 0.331 (based on data from "Inequality in 1200 Popular Films," by Smith, et al., Annenberg...

-

Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership....

-

Exercise 6-10A (Algo) Double-declining-balance and units-of-production depreciation: gain or loss on disposal LO 6-3, 6-4, 6-5 Exact Photo Service purchased a new color printer at the beginning of...

-

Independent Events Again assume that when randomly selecting a speaking character in a movie, the probability of getting a female is 0.331, as in Exercise 1. If we want to find the probability of 20...

-

You've been given the critical assignment of selecting the site for your company's new plant. After months of negotiations with landowners, numerous cost calculations, and investments in ecological,...

-

Three forces with magnitudes of 70pounds, 40 pounds, and 60 pounds act on an object at angles of 30, 45, and 135, respectively, with the positive x-axis. Find the direction and magnitude of the...

-

When a manager notices that Sheryl has strong social needs and assigns her a job in customer relations and gives Farhad lots of praise because of his strong ego needs, the manager is displaying...

-

The loan-processing department would be considered a ____________ of your local bank or credit union. (a) subsystem (b) closed system (c) resource input (d) cost centre

-

Resource acquisition and customer satisfaction are important when an organization is viewed as a(n) ____________. (a) bureaucracy (b) closed system (c) open system (d) pyramid

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App