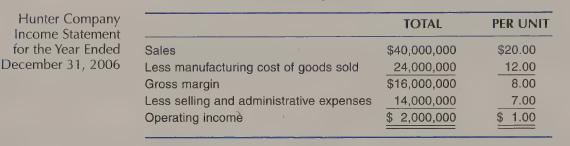

The following is the income statement of a manufacturer of blue jeans: Hunter had manufactured 2 million

Question:

The following is the income statement of a manufacturer of blue jeans:

Hunter had manufactured 2 million units, which had been sold to various clothing wholesalers and department stores. In early 2007, the president, Rosemary Munoy, died of a stroke. Her son, Hector, became the new president.

Hector has worked for 15 years in the marketing department of the business. He knows very little about accounting and manufacturing, which were his mother’s strengths. Hector has several questions for you, including inquiries regarding the pricing of special orders.

1. To prepare better answers, you decide to recast the income statement in contribution form. Variable manufacturing cost was $19 million.

Variable selling and administrative expenses, which were mostly sales commissions, shipping expenses, and advertising allowances, paid to customers based on units sold, were $9 million.

Hector asks, “I can’t understand financial statements until I know the meaning of various terms. In scanning my mother’s assorted notes, I found the following pertaining to both total and unit costs: absorption cost, full manufacturing cost, variable cost, full cost, fully allocated cost, gross margin, contribution margin. Using our data for 2006, please give me a list of these costs, their total amounts, and their per-unit amounts.”

. “Near the end of 2006 I brought in a special order from The Bay for 100,000 pairs of jeans at $17 each. I said I’d accept a flat $20,000 sales commission instead of the usual 6 percent of selling price, but my mother refused the order. She usually upheld a relatively rigid pricing policy, saying that it was bad business to accept orders that did not generate, at least, full manufacturing cost plus 80 percent.

“That policy bothered me. We had idle capacity. The way I figured, our manufacturing costs would go up by 100,000 x $12 = $1,200,000, but our selling and administrative expenses would only go up by $20,000. That would mean additional operating income of 100,000 * ($17 —$12) minus 20,000, or $500,000 minus $20,000 or $480,000. That’s too much money to give up just to maintain a general pricing policy. Was my analysis of the impact on operating income correct?

If not, please show me the correct additional operating income.”

4. After receiving the explanations offered in requirements 2 and 3, Hector said: “Forget that I had The Bay order. I had an even bigger order from Wal-Mart. It was for 500,000 units and would have filled the plant completely.

I told my mother I'd settle for no commission. There would have been no selling and administrative costs whatsoever because Wal-Mart would pay for the shipping and would not get any advertising allowances.

“Wal-Mart offered $9.20 per unit. Our fixed manufacturing costs would have been spread over 2.5 million instead of 2 million units.

Wouldn't it have been advantageous to accept the offer? Our old fixed manufacturing costs were $2.50 per unit. The added volume would reduce that cost more than our loss on our variable costs per unit.

“Am I correct? What would have been the impact on total operating income if we had accepted the order?”

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas