The following summarized data are available on three job-cost records of Weeks Company, a manufacturer of packaging

Question:

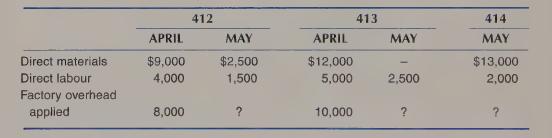

The following summarized data are available on three job-cost records of Weeks Company, a manufacturer of packaging equipment:

The company’s fiscal year ends on May 31. Factory overhead is applied as a percentage of direct-labour costs. The balances in selected accounts on April 30 were direct materials inventory, $19,000; and finished-goods inventory, $18,000.

Job 412 was completed during May and transferred to finished goods. Job 413 was still in process at the end of May as was Job 414, which had begun on May 24. These were the only jobs worked on during April and May.

Job 412 was sold along with other finished goods by May 30. The total cost of goods sold during May was $33,000. The balance in cost of goods sold on April 30 was $450,000.

1. Prepare a schedule showing the balance of the work-in-process inventory, April 30. This schedule should show the total costs of each job record. Taken together, the job-cost records are the subsidiary ledger supporting the general-ledger balance of work-in-process.

2. What is the overhead application rate?

3. Prepare summary general-journal entries for all costs added to workin-

process during May. Also prepare entries for all costs transferred from work-in-process to finished goods and from finished goods to cost of goods sold. Post to the appropriate T-accounts.

4. Prepare a schedule showing the balance of the work-in-process inventory, May 31.

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas