The RS Group owns a large store in Ludborough. The store is oldfashioned and profits are declining.

Question:

The RS Group owns a large store in Ludborough. The store is oldfashioned and profits are declining. Management is considering what to do. There appear to be three possibilities:

1. Shut down and sell the site for $\$ 15 \mathrm{~m}$.

2. Continue as before with profits declining.

3. Upgrade the store.

The Group has had problems in the past and experience suggests that when stores are upgraded, $60 \%$ achieve good results and $40 \%$ poor results.

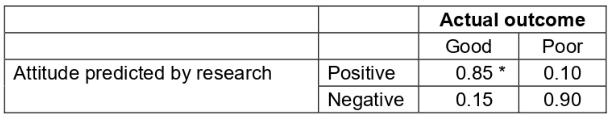

Because of the doubts, management is considering whether to contact a leading market research company to carry out consumer research in Ludborough for $\$ 1 \mathrm{~m}$. It has been fortunate in obtaining details of the track record of the research company, as follows:

* This means that when the actual results were good the research had predicted this $85 \%$ of the time.

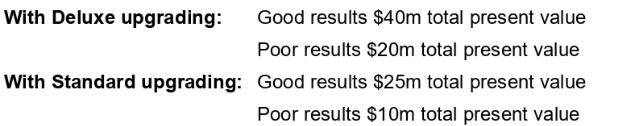

If the research indicates a positive attitude, management will consider deluxe upgrading which will generate more profit but will cost $\$ 12 m$, as compared with standard upgrading costing $\$ 6 \mathrm{~m}$.

If the research indicates a negative attitude, then management will consider standard upgrading compared with shutting down and selling the site.

The time scale for the analysis is 10 years and the following estimates of returns have been made:

If operations continue as before, returns over the next 10 years will be $\$ 13.03 \mathrm{~m}$ in present value terms.

Required:

(a) prepare a decision tree to represent the above information.

(b) calculate what decisions should be taken.

(c) explain the basis of your analysis.

Step by Step Answer: