The Seoul division of Global Toy Company manufactures chess boards and sells them in the Korean market

Question:

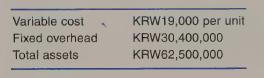

The Seoul division of Global Toy Company manufactures chess boards and sells them in the Korean market for KRW30,000 each. (KRW is the Korean won.) The following data are from the Seoul Division’s 2006 budget:

Global Toy has instructed the Seoul Division to budget a rate of return on total assets (before taxes) of 20 percent.

1. Suppose the Seoul Division expects to sell 3,400 chess boards during 2006:

a. What rate of return will be earned on total assets?

b. What would be the expected capital turnover?

c. What would be the operating income percentage of sales?

2. The Seoul Division is considering adjustments in the budget to reach the desired 20 percent rate of return on total assets.

a. How many units must be sold to obtain the desired return if no other part of the budget is changed?

b. Suppose sales cannot be increased beyond 3,400 units. How much must total assets be reduced to obtain the desired return? Assume that for every KRW1,000 decrease in total assets, fixed costs decrease by KRW100.

3. Assume that only 2,400 units can be sold in the Korean market.

However, another 1,400 units can be sold to the North American Marketing Division of Global Toy. The Seoul manager has offered to sell the 1,400 units for KRW27,500 each. The North American Marketing Division manager has countered with an offer to pay KRW25,000 per unit, claiming she can subcontract production to a North American producer at a cost equivalent to KRW25,000. The Seoul manager knows that if his production falls to 2,400 units, he could eliminate some assets, reducing total assets to KRW50 million and annual fixed overhead to KRW24.5 million. Should the Seoul manager sell for KRW25,000 per unit? Support your answer with the relevant computations.

Ignore the effects of income taxes and import duties.

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas