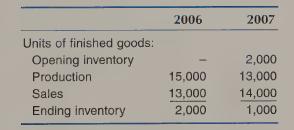

The Trapani Company had the following actual data for 2006 and 2007: The basic production data at

Question:

The Trapani Company had the following actual data for 2006 and 2007:

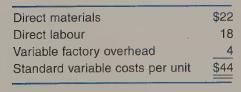

The basic production data at standard unit costs for the two years were

Fixed factory overhead was budgeted at $98,000 per year. The expected volume of production was 14,000 units, so the fixed overhead rate was $98,000 = 14,000 = $7 per unit.

Budgeted sales price was $75 per unit. Selling and administrative expenses were budgeted at variable, $9 per unit sold, and fixed, $80,000 per year.

Assume that there were absolutely no variances from any standard variable costs, budgeted selling prices, or budgeted fixed costs in 2006.

There were no beginning or ending inventories of work-in-process.

1. For 2006, prepare income statements based on variable costing and absorption costing. (The next problem deals with 2007.)

2. Explain why operating income differs between variable costing and absorption costing. Be specific.

Step by Step Answer:

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas