The Whole Company is an integrated multidivisional manufacturing firm. Two of its divisions, Rod and Champ, are

Question:

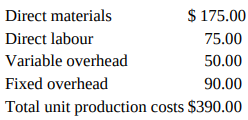

The Whole Company is an integrated multidivisional manufacturing firm. Two of its divisions, Rod and Champ, are profit centres and their division managers have full responsibility for production and sales (both internal and external). Both the Rod and Champ division managers are evaluated by top management on the basis of total profit. Rod division is the exclusive producer of a special equipment component called Q-32. The Rod division manager used the results of a market study to set the price at $450 per unit of Q-32. At this price, the normal sales and production volume is 21,000 units per year; however, production capacity is 26,000 units per year. Standard production costs for one unit of Q-32 based on normal production volume are as follows.

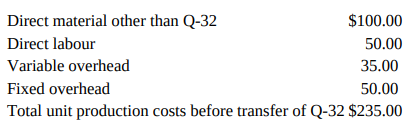

Champ division produces machinery for several large customers on a contractual basis. It has recently been approached by a potential customer to produce a specially designed machine that would require one unit of Q-32 as its main component. The potential customer has indicated that it would be willing to sign a long-term contract for 10,400 units of the machine per year at a maximum price of $650 per unit. Although Champ division has sufficient idle capacity to accommodate the production of this special machine, the division manager is not willing to accept the contract unless he can negotiate a reasonable transfer price with the Rod division manager for Q-32. He has calculated that the unit costs to produce the special machine are as follows:

Required

1. What is the maximum unit transfer price that the Champ division manager should be willing to accept for Q-32 if he wishes to accept the contract for the special machine? Support your answer.

2. What is the minimum unit transfer price that the Rod division manager should be willing to accept for Q-32? Support your answer.

3. Assume that Rod division would be able to sell its capacity of 26,000 units of Q-32 per year in the outside market if the selling price was reduced by 5 percent. From top management’s point of view, evaluate, considering both quantitative and qualitative factors, whether Rod division should lower its market price or transfer the required units of Q32 to Champ division. What would you recommend? Why?

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu