This is an expansion of E14-8. The primary difference between the EVA and residual income measures is

Question:

This is an expansion of E14-8. The primary difference between the EVA and residual income measures is the increased focus on cash flow by EVA. EVA companies make several adjustments to both operating income from the income statement and invested capital from the balance sheet. Common examples of these adjustments are inventory adjustments and reporting warranty costs on a cash basis. Most EVA companies make only a few such adjustments (from 5 to 15).

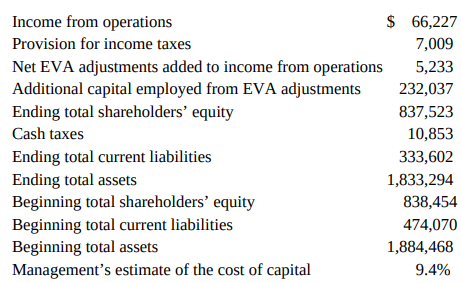

The following data are from the 2008 annual report of Briggs & Stratton (thousands of dollars).

Prepare a schedule that calculates and compares EVA to residual income for Briggs & Stratton.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu