Wallaby Kite Company, a small Melbourne firm that sells kites on the Web, wants a master budget

Question:

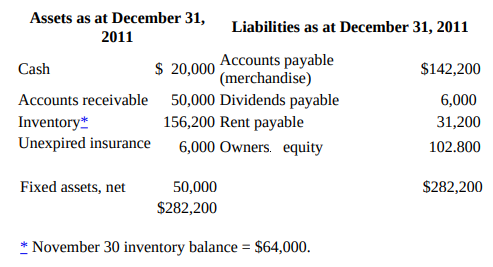

Wallaby Kite Company, a small Melbourne firm that sells kites on the Web, wants a master budget for the three months beginning January 1, 2012. It desires an ending minimum cash balance of $20,000 each month. Sales are forecast at an average wholesale selling price of $8 per kite. Merchandise costs average $4 per kite. All sales are on credit, payable within 30 days, but experience has shown that 60 percent of current sales are collected in the current month, 30 percent in the next month, and 10 percent in the month thereafter. Bad debts are negligible.

In January, Wallaby Kite is beginning just-in-time (JIT) deliveries from suppliers, which means that purchases will equal expected sales. On January 1, purchases will cease until inventory decreases to $24,000, after which time purchases will equal sales. Purchases during any given month are paid in full during the following month. Monthly operating expenses are as follows:

Wages and salaries....$60,000

Insurance expired...........500

Depreciation.................1,000

Miscellaneous.............10,000

$1,000/month + 10% of quarterly sales over

Rent...........................$40,000

Cash dividends of $6,000 are to be paid quarterly, beginning January 15, and are declared on the 15th of the previous month. All operating expenses are paid as incurred, except insurance, depreciation, and rent. Rent of $1,000 is paid at the beginning of each month, and the additional 10 percent of sales is paid quarterly on the 10th of the month following the end of the quarter. The next rent settlement date is January 10.

The company plans to buy some new fixtures for $12,000 cash in March.

Money can be borrowed and repaid in multiples of $2,000. Management wants to minimize borrowing and repay rapidly. Simple interest of 10 percent per annum is computed monthly but paid when the principal is repaid. Assume that borrowing occurs at the beginning, and repayments at the end, of the months in question. Compute interest to the nearest dollar.

Recent and forecast sales: October $152,000 December $100,000 February $280,000 April $180,000 November 100,000 January 248,000 March 152,000 1. Prepare a master budget including a budgeted income statement, balance sheet, cash budget, and supporting schedules for the months January through March 2012. 2. Is there a cash surplus or a cash deficit? What should be done about the surplus or deficit?

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu