You are working for an NHS Trust. The Trust manages three hospitals. Two of these, Triumph and

Question:

You are working for an NHS Trust. The Trust manages three hospitals. Two of these, Triumph and BSA, are district general hospitals, while the third, Norton, is a small cottage-style hospital. The cleaning service contract for these hospitals is managed in-house by the Trust’s own cleaning services. The target for the cleaning contract is the breakeven of revenue and expenditure. The contract was let two years ago and is due for renewal on 1 April 2005 so has one year to run.

At the request of your section head you are monitoring the performance of the contract for the financial year ending the 31 March 2004 and have obtained the following information.

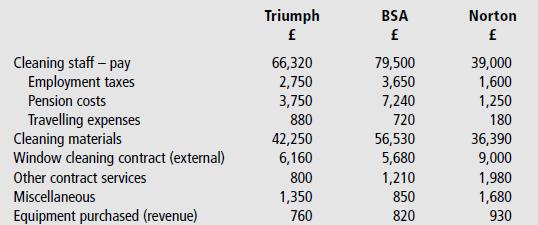

(1) Financial data: payments 2003/04

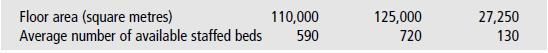

(2) Statistical data

(3) Additional Information

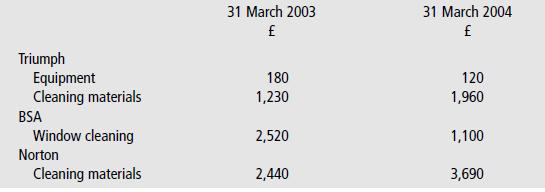

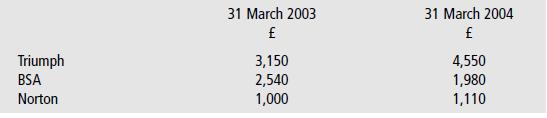

(a) Sundry creditors were:

(b) Cleaning materials issued from the central stores have not been included in part (1) payments as they were issued in the last week of March 2004 and the Finance Department has only just been informed. These stock issues were:

Triumph, £1,260; BSA, £1,140; Norton, £2,460.

(c) Stocks of cleaning materials in hand at each hospital at the year end were:

(d) The central stores cost for managing cleaning materials is to be apportioned to the three hospitals and has been calculated for 2003/04 at £66,000. There is no agreed basis of allocation of this cost to the three hospitals.

(e) During 2003/2004 BSA hospital required that a cleaning equipment maintenance contract be negotiated for £600 per annum payable annually in advance on 1 February in each year. This payment is included in (1) under other contract services. The contract is renewable annually now it has been signed.

(f) Outstanding bonuses in respect of BSA and Norton at the 31 March 2004 are 1.5% of wages paid in the year. This has no effect on other wage related costs.

(g) The cost of management supervision by the cleaning supervisor is £18,000 including overheads.

(h) Staff time for finance services provided by the Finance Department has yet to be charged to the cleaning contract and is to be allocated to each hospital on the basis of floor area. The costs calculated by the finance department are £20,000 for these services. This is in part based on the work that this year went into preparing a bid for the renewal (£10,000) of the contract on 1 April 2005.

There will be significantly more work in the next financial year to prepare for the retendering exercise.

(i) Cleaning the hospitals requires no capital equipment.

(j) The value of the cleaning contract is £530,000. It is not broken down by individual hospital.

As a management accountant working for the Trust you have been requested to prepare a report on the cleaning service.

(i) Include a statement showing the cleaning costs for each hospital in comparison with the tendered price.

(ii) Discuss the relative cleaning costs for each hospital and outline the possible reasons for variations between them.

(iii) Comment on any qualitative factors you believe are relevant.

(iv) Make appropriate recommendations based on your analysis in the context of 2003/04 and the retendering exercise due in 2005/06.

Step by Step Answer:

Management Accounting Principles And Applications

ISBN: 9781412908436

1st Edition

Authors: Hugh Coombs, D Ellis Jenkins, David Hobbs