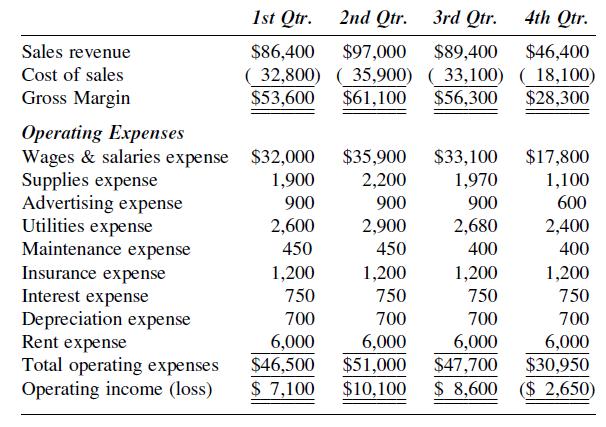

You have the following income statements for each of the four quarters of a restaurant operation: The

Question:

You have the following income statements for each of the four quarters of a restaurant operation:

The owner is contemplating closing the restaurant in the fourth quarter in order to eliminate the loss and take a three-month vacation. The owner has asked for your help, and after an analysis of the fourth-quarter expenses, you determine the following:

■ Wages and salaries expense: $3,000 is a fixed cost of key personnel who would be kept on the payroll even if the operation were closed for three months.

■ Supplies expense: Cost varies directly with sales revenue; none of the supplies costs are fixed.

■ Advertising expense: Half of the cost is fixed; the rest of the cost is variable.

■ Utilities expense: Even if closed for three months, the restaurant will still require some heating; this is expected to cost $100 a month.

■ Maintenance expense: Some light maintenance work could be done during the closed period; estimated cost is $200.

■ Insurance expense: Insurance cost will be reduced 60% if closed for three months.

■ Interest expense: Will still have to be paid, even if closed.

■ Depreciation expense: With less customer traffic and reduced wear and tear on equipment, there would be a 75% reduction in depreciation expense for the fourth quarter.

■ Rent expense: This is an annual expense of $24,000 that must be paid, regardless of whether the restaurant is open or closed.

Explain what advice you would give the owner.LO1

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471687894

9th Edition

Authors: Martin G Jagels, Catherine E Ralston