Cathedral City Services (CCS) is a not-for-profit organization offering two services in a midsized city. The services

Question:

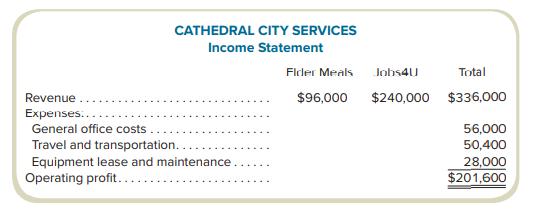

Cathedral City Services (CCS) is a not-for-profit organization offering two services in a midsized city. The services are “Elder Meals” and “Jobs 4U.” Elder Meals is a meals-on-wheels type program that delivers meals on a scheduled basis to seniors who are house-bound. Jobs 4U is a jobs-training program focused on youth or adults who are looking to change careers. Participants in the program are sponsored by a local government agency, a charitable organization, or a local business. CCS charges a $240 fee per hour for each service. The revenues and costs for the year are shown in the following income statement:

The following data have been collected concerning activities at CCS:

Required

a. Complete the income statement using activity-based costing and CCS’s three cost drivers.

b. Recompute the income statement using direct labor-hours as the only allocation base (400 hours for Elder Meals; 1,000 hours for Jobs 4U).

c. How might CCS’s decisions regarding pricing or dropping a service be altered if the organization were to allocate all overhead costs using direct labor-hours?

d. Under what circumstances would the labor-based allocation and activity-based costing (using CCS’s three cost drivers) result in similar profit results?

e. A regional government agency is looking for worthy causes to support through financial grants. A primary criterion for support is financial need. CCS is thinking of applying for support for the Elder Meals program. Which allocation method would give CCS the best chance of winning a grant? Would it be ethical for CCS to report the income using this method in their application?

Step by Step Answer: