The Alpha group comprises two companies, X Limited and Y Limited both of which are resident in

Question:

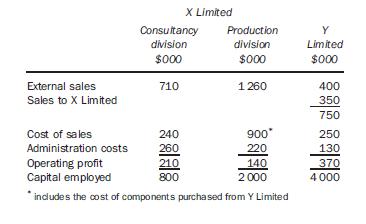

The Alpha group comprises two companies, X Limited and Y Limited both of which are resident in a country where company profits are subject to taxation at 30 per cent.

X Limited

X Limited has two trading divisions:

Consultancy division – provides consultancy services to the engineering sector.

Production division – assembles machinery which it sells to a number of industry sectors. Many of the components used in these machines are purchased from Y Limited.

Y Limited

Y Limited manufactures components from raw materials many of which are imported. The components are sold globally. Some of the components are sold to X Limited.

Financial results

The financial results of the two companies for the year ended 30 September 2010 are as follows:

Required:

(a) Discuss the performance of each division X Limited and of Y Limited using the following three ratios:

(i) Return on Capital Employed (ROCE)

(ii) Operating Profit Margin (iii) Asset Turnover

Transfer Prices

The current policy of the group is to allow the managers of each company or division to negotiate with each other concerning the transfer prices.

The manager of Y Limited charges the same price internally for its components that it charges to its external customers. The manager of Y argues that this is fair because if the internal sales were not made he could increase his external sales. An analysis of the market demands shows that currently Y Limited satisfies only 80% of the external demand for its components.

The manager of the Production division of X Limited believes that the price being charged to Y Limited for the components is too high and is restricting X Limited’s ability to win orders. Recently X Limited failed to win a potentially profitable an order which it priced using its normal gross profit mark-up. The competitor who won the order set a price that was less than 10 per cent lower than X Limited’s price.

An analysis of the cost structure of Y Limited indicates that 40% of the cost of sales is fixed costs and the remaining costs vary with the value of sales.

Required:

(b) (i) Discuss how the present transfer pricing policy is affecting the overall performance of the group.

(ii) Explain, including appropriate calculations, the transfer price or prices at which the components should be supplied by Y Limited to X Limited.

(c) The group Managing Director is considering relocating Y Limited to a country that has a much lower rate of company taxation than that in its current location.

Required:

Explain the potential tax consequences of the internal transfer pricing policy if Y Limited were to relocate.

Step by Step Answer: