XY provides accountancy services and has three different categories of client: limited companies, self employed individuals, and

Question:

XY provides accountancy services and has three different categories of client:

limited companies, self employed individuals, and employed individuals requiring taxation advice. XY currently charges its clients a fee by adding a 20% mark-up to total costs. Currently the costs are attributed to each client based on the hours spent on preparing accounts and providing advice.

XY is considering changing to an activity based costing system.

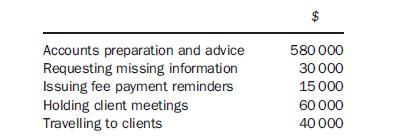

The annual costs and the causes of these costs have been analyzed as follows:

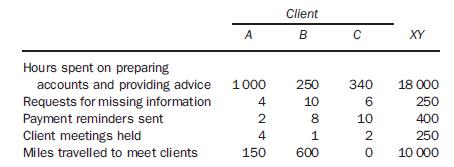

The following details relate to three of XY’s clients and to XY as a whole:

Required:

Prepare calculations to show the effect on fees charged to each of these three clients of changing to the new costing system.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: