A company manufactures and sells a single product. The company operates a standard marginal costing system that

Question:

A company manufactures and sells a single product. The company operates a standard marginal costing system that enables the reporting of planning and operational variances.

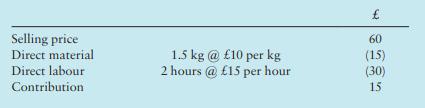

The original standard contribution per unit of the product for October, which was used to establish the budgeted contribution for the month, was as follows:

Other information for October

Sales and production quantities:

Budgeted sales and production 40,000 units

Actual sales and production 42,000 units

A change in the product specification was implemented at the start of October which required 20% additional material for each unit. The standard cost shown above was not revised to reflect this change.

Actual direct material purchased and used was 78 000 kg at £9.90 per kg.

The labour rate shown in the standard cost above was overestimated. The correct standard labour rate for the grade of labour required was £14.60 per hour. The actual rate paid was £15.20 per hour and actual hours worked were 86 000 hours.

The actual selling price per unit was £62.

There was no opening inventory of raw materials or finished goods.

Required

1. Prepare a statement for October that reconciles the budgeted contribution with the actual contribution. Your statement should show the variances in as much detail as possible.

2. Discuss the performance of the company for October. Your discussion should give one possible reason for each of the operational variances calculated in part (a).

3. Explain why separating variances into their planning and operational elements should improve performance management.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan