Advanced: Accounting Rate of Return Armcliff Ltd is a division of Shevin pic which requires each of

Question:

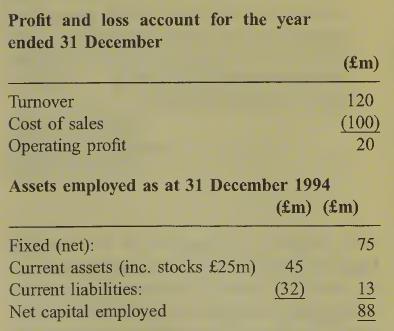

Advanced: Accounting Rate of Return Armcliff Ltd is a division of Shevin pic which requires each of its divisions to achieve a rate of return on capital employed of at least 10% p.a. For this purpose, capital employed is defined as fixed capital and investment in stocks

. This rate or return is also applied as a hurdle rate for new investment projects. Divisions have limited borrowing powers and all capital projects are centrally funded.

The following is an extract from Armcliff’s divisional accounts:

Armcliff’s production engineers wish to invest in a new computer-controlled press. The equipment cost is £14m. The residual value is expected to be £2m after four years operation, when the equip¬ ment will be shipped to a customer in South America.

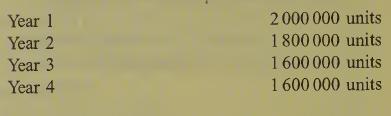

The new machine is capable of improving the quality of the existing product and also of producing a higher volume. The firm’s marketing team is confident of selling the increased volume by extending the credit period. The expected addi¬ tional sales are:

Sales volume is expected to fall over time due to emerging competitive pressures. Competition will also necessitate a reduction in price by £0.5 each year from the £5 per unit proposed in the first year. Operating costs are expected to be steady at £1 per unit, and allocation of overheads (none of which are affected by the new project) by the central finance department is set at £0.75 per unit.

Higher production levels will require additional investment in stocks of £0.5m, which would be held at this level until the final stages of operation of the project. Customers at present settle accounts after 90 days on average.

Required:

(a) Determine whether the proposed capital investment is attractive to Armcliff, using the average rate of return on capital method, as defined as average profit-to-average capital employed, ignoring debtors and creditors. [Note: Ignore taxes] (7 marks)

(b) (i) Suggest three problems which arise with the use of the average return method for appraising new investment. (3 marks) (ii) In view of the problems associated with the ARR method, why do companies continue to use it in project appraisal?

(3 marks) (Total 13 marks) ACCA Paper 8 Managerial Finance

Step by Step Answer: