Advanced: Calculation of elasticity of demand, optimum output and selling price XYZ is the only manufacturer of

Question:

Advanced: Calculation of elasticity of demand, optimum output and selling price XYZ is the only manufacturer of a product called the X. The variable cost of producing an X is £1.50 at all levels of output.

During recent months the X has been sold at a unit price of around £6.25. Various small adjust¬ ments (up and down) have been made to this price in an attempt to find a profit maximising selling price.

XYZ’s Commercial Manager (an economics graduate) has recently commissioned a study by a firm of marketing consultants ‘to investigate the demand structure for Xs and in particular to calculate the elasticity of demand for Xs produced by XYZ’. (Note: the elasticity of demand for a product is the proportion by which demand changes divided by the proportional price change which causes it.)

The consultants have reported back that at a unit price of £10 there is no demand for Xs but that demand increases by 40 Xs for each lp (£0.01) that the unit price is reduced below £10. They have also reported that ‘when demand is at around half its theoretical maximum the elasticity of demand is approximately 1.’

Upon receiving this report the Commercial Manager makes the following statement:

Recent experiences gained in adjusting the unit selling price of the X suggest that the product has quite an elastic demand structure. Small changes in the unit selling price produce far larger proportionate increases in demand. I find it difficult to accept that the elasticity of demand for the X is 1.

You are required:

(a) to write a memorandum to the Commercial Manager reconciling the consultants’ report with his own observations on the elasticity of demand for the X; (10 marks)

(b) to calculate the profit maximising unit selling price for the X (accurate to the nearest penny) and to calculate the elasticity of demand for the X at that selling price; (10 marks)

(Total 20 marks) CIMA Stage 4 Management Accounting Decision Making 11.14* Advanced: Calculation of cost-plus price and minimum short-run price plus a discussion of cost-plus and relevant cost pricing Wright is a builder. His business will have spare capacity over the coming six months and he has been investigating two projects.

Project A Wright is tendering for a school extension contract. Normally he prices a contract by adding 100% to direct costs, to cover overheads and profit. He calculates direct costs as the actual cost of mater¬ ials valued on a first-in-first-out basis, plus the estimated wages of direct labour. But for this contract he has prepared more detailed informa¬ tion.

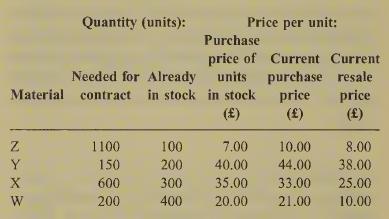

Four types of material will be needed:

Z and Y are in regular use. Neither X nor W is currently used; X has no foreseeable use in the business, but W could be used on other jobs in place of material currently costing £16 per unit.

The contract will last for six months and requires two craftsmen, whose basic annual wage cost is £16000 each. To complete the contract in time it will also be necessary to pay them a bonus of £700 each. Without the contract they would be retained at their normal pay rates, doing work which will otherwise be done by temporary work¬ ers engaged for the contract period at a total cost of £11 800.

Three casual labourers would also be employed specifically for the contract at a cost of £4000 each.

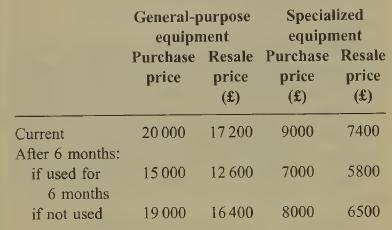

The contract will require two types of equip¬ ment: general-purpose equipment already owned by Wright, which will be retained at the end of the contract, and specialized equipment to be purchased second-hand, which will be sold at the end of the contract.

The general-purpose equipment cost £21 000 two years ago and is being depreciated on a straight-line basis over a seven-year life (with assumed zero scrap value). Equivalent new equip¬ ment can be purchased currently for £49 000. Second-hand prices for comparable general- purpose equipment, and those for the relevant specialized equipment, are shown below.

The contract will require the use of a yard on which Wright has a four-year lease at a fixed rental of £2000 per year. If Wright does not get the contract the yard will probably remain empty. The contract will also incur administrative expenses estimated at £5000.

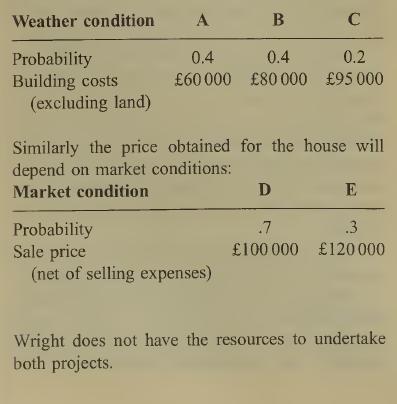

Project B If Wright does not get the contract he will buy a building plot for £20000 and build a house. Building costs will depend on weather conditions:

The costs of his supervision time can be ignored.

Requirements

(a) Ignoring the possibility of undertaking project B, calculate:

(i) the price at which Wright would tender for the school extension contract if he used his normal pricing method, and (ii) the tender price at which you consider Wright would neither gain nor lose by taking the contract. (10 marks)

(b) Explain, with supporting calculations, how the availability of project B should affect Wright’s tender for the school extension contract. (5 marks)

(c) Discuss the merits and limitations of the pricing methods used above, and identify the circumstances in which they might be appro¬ priate.LO1

Step by Step Answer: