Advanced: Calculation of learning rate and contract completion using the learning curve. Maxmarine plc builds boats. Earlier

Question:

Advanced: Calculation of learning rate and contract completion using the learning curve. Maxmarine plc builds boats.

Earlier this year the company accepted an order for 15 specialized

‘Crest’ boats at a fixed price of £100000 each. The contract allows four months for building and delivery of all the boats and stipulates a penalty of £10000 for each boat delivery late.

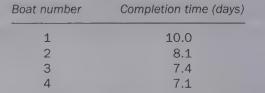

The boats are built using purchased components and internally manufactured parts, all of which are readily available. However, there is only a small team of specialized technicians and boatyard space is limited, so that only one boat can be built at a time. Four boats have now been completed and as Maxmarine plc has no previous experience of this particular boat the building times have been carefully monitored as follows:

Maxmarine plc has 23 normal working days in every month and the first four boats were completed with normal working.

Management is now concerned about completing the contract on time.

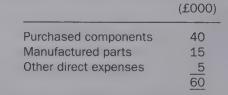

The management accountant’s estimate of direct costs per boat, excluding labour costs, is as follows:

Direct labour costs are £2500 per day for the normal 23 working days per month. Additional weekend working days at double the normal pay rates can be arranged up to a maximum of seven days per month (making 30 possible working days per month in total).

Overheads will be allocated to the contract at a rate of £3000 per normal working day and no overheads will be allocated for overtime working.

Requirements:

(a) Using the completion time information provided, calculate the learning rate showing full workings. (6 marks)

(b) Discuss the limitations of the learning curve in this type of application. (6 marks)

(c) Calculate whether it would be preferable for Maxmarine plc to continue normal working or to avoid penalties by working weekends. Support your calculations with any reservations or explanations you consider appropriate. (13 marks)

ICAEW Management Accounting

Step by Step Answer: