Advanced: Calculation of min imu m selli ng pri ce of a machine based on PV of

Question:

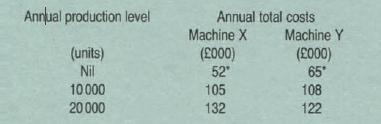

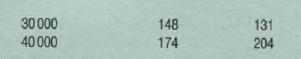

Advanced: Calculation of min imu m selli ng pri ce of a machine based on PV of future cash flows FG Ltd has two machines used on a contract for a large customer, LC Ltd. Each machine can produce the same product and has a capacity of 40000 units per year, but each has different characteristics resulting in the following total annual costs at different production levels which must be in lots of 10000 units:

• This figure includes:

Direct materials Direct labour }usabl~ in other ~lions of the company if the Direct expenses mach1ne were disposed of Depreciation £8 000 p.a.

Apportioned production overhead £12000 p.a.

The contract price to LC Ltd is £6.00 per unit. The company's cost of capital is 13%.

FG Ltd expects that sales will end in five years' time and that the quantities required by LC Ltd will average 75% of its present total capacity.

FG Ltd has received an invitation to sell either of the machmes to an overseas organization and must decide whether it should do so and, if so, at what price. If it retains either or both machines, each is expected to have a scrap value of £20 000 in five years'

time. If one of the machines is sold to the overseas organization, FG Ltd will not have to pay any penalty to LC Ltd on account of any shortfall in delivery.

You are required

(a) to set out a table from 10 000 to 80 000 units to show wh1ch machine or combination of machines should be used at each level to yield minimum costs to FG Ud; (7 marks)

(b) to recommend to FG Ltd (i) which level of total unit sales will yield the largest profit, (3 marks)

(ii) which machine it should offer to the overseas company and the minimum price at which it should offer that machine (to the nearest £1000 upwards); (9 marks)

Show your supporting calculations.

(c) assuming that the price at

(b) (ii) above is acceptable, to explain briefly three major factors that FG Ltd should consider when making its eventual decision. (6 marks)

Ignore taxation.

Step by Step Answer: