Advanced: Calculation of optimum quantity and prices for Joint products using differential calculus plus a discussion of

Question:

Advanced: Calculation of optimum quantity and prices for Joint products using differential calculus plus a discussion of joint cost allocations Nuts pic produces alpha and beta in two stages. The separation process produces crude alpha and beta from a raw material costing £170 per tonne. The cost of the separation process is £100 per tonne of raw material. Each tonne of raw material generates 0.4 tonne of crude alpha and 0.6 tonne of crude beta. Neither product can be sold in its crude state.

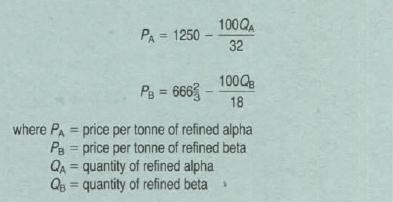

The refining process costs £125 per tonne for alpha and £50 per tonne for beta; no weight is lost in refining. The demand functions for refined alpha and refined beta are independent of each other, and the corresponding price equations are

The company is considering whether any part of the production of crude alpha or crude beta should be treated as a by-product. The by-product would be taken away free of charge by a large-scale pig farming enterprise.

Requirements

(a) If all the output of the separation process is refined and sold:

(i) calculate the optimal quantity of raw material to be processed and the quantities and prices of the refined products, and (ii) determine the 'major' product which IS worth refining and the 'minor' product which deserves consideration as a potential by-product. but do not attempt to calculate at this stage how much of the 'minor' product would be refined. (10 marks)

(b) Calculate:

(i) the optimal quantity of the 'major' product which would be worth producing regardless of the value of the 'minor'

product. and (ii) the quantity of the resulting 'minor' product that would be worth refining (6 marks)

(c) Evaluate the principal methods and problems of joint-cost allocation for stock valuation, referring to Nuts pic where appropriate.

Step by Step Answer: