Advanced: Calculation of optimum selling price, learning curve and pricing policies. Heat Co specialises in the production

Question:

Advanced: Calculation of optimum selling price, learning curve and pricing policies. Heat Co specialises in the production of a range of air conditioning appliances for industrial premises.

If is about to launch a new product, the ‘Energy Buster’, a unique air conditioning unit which is capable of providing unprecedented levels of air conditioning using a minimal amount of electricity.

The technology used in the Energy Buster is unique so Heat Co has patented it so that no competitors can enter the market for two years. The company’s development costs have been high and it is expected that the product will only have a five-year life cycle.

Heat Co is now trying to ascertain the best pricing policy that they should adopt for the Energy Buster’s launch onto the market.

Demand is very responsive to price changes and research has established that, for every $15 increase in price, demand would be expected to fall by 1000 units. If the company set the price at

$735, only 1000 units would be demanded.

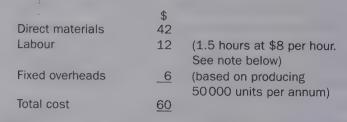

The costs of producing each air conditioning unit are as follows:

Note The first air conditioning unit took 1.5 hours to make and labour cost $8 per hour. A 95 per cent learning curve exists, in relation to production of the unit, although the learning curve is expected to finish after making 100 units. Heat Co’s management has said that any pricing decisions about the Energy Buster should be based on the time it takes to make the 100th unit of the product. You have been told that the learning co-efficient, b = —0.0740005.

All other costs are expected to remain the same up to the maximum demand levels.

Required:

(a) ({) Establish the demand function (equation) for air conditioning units; (3 marks)

(ii) Calculate the marginal cost far each air conditioning unit after adjusting the labour cost as required by the note above; (6 marks) (iii) Equate marginal cost and marginal revenue in order to calculate the optimum price and quantity.

(3 marks)

(b) Explain what is meant by a ‘penetration pricing’ strategy and a ‘market skimming’ strategy and discuss whether either strategy might be suitable for Heat Co when launching the Energy Buster. (8 marks)

ACCA F5 Performance Management

Step by Step Answer: