Advanced: Calculation of traditional and ABC product costs. A major company sells a range of electrical, clothing

Question:

Advanced: Calculation of traditional and ABC product costs. A major company sells a range of electrical, clothing and homeware products through a chain of department stores. The main administration functions are provided from the company’s head office. Each department store has its own warehouse which receives goods that are delivered from a central distribution centre.

The company currently measures profitability by product group for each store using an absorption costing system. All overhead costs are charged to product groups based on sales revenue.

Overhead costs account for approximately one-third of total costs and the directors are concerned about the arbitrary nature of the current method used to charge these costs to product groups.

A consultant has been appointed to analyse the activities that are undertaken in the department stores and to establish an activity-based costing system.

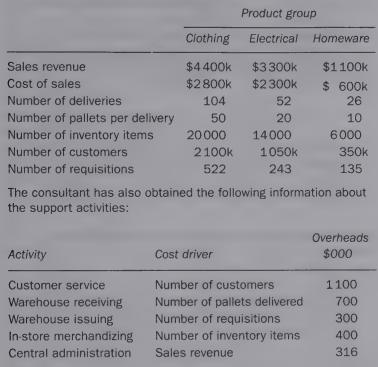

The consultant has identified the following data for the latest period for each of the product groups for the X town store:

Required:

(a) Calculate the total profit for each of the product groups:

(i) using the current absorption costing system;

(4 marks)

(ii) using the proposed activity-based costing system.

(9 marks)

(b) Explain how the information obtained from the activity-based costing system might be used by the management of the company. (6 marks)

(c) Explain the circumstances under which an activitybased costing system would produce similar product costs to those produced using a traditional absorption costing system. (6 marks)

CIMA Pi Performance Operations

Step by Step Answer: