Advanced: Calculation of unit costs and optimum selling price French Ltd is about to commence operations utiliz

Question:

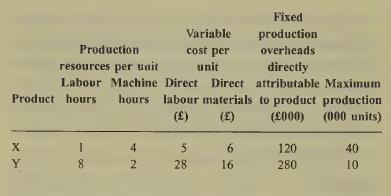

Advanced: Calculation of unit costs and optimum selling price French Ltd is about to commence operations utiliz¬ ing a simple production process to produce two products X and Y. It is the policy of French to operate the new factory at its maximum output in the first year of operations. Cost and production details estimated for the first year’s operations are:

There are also general fixed production overheads concerned in the manufacture of both products but which cannot be directly attributed to either. This general fixed production overhead is estimated at £720000 for the first year of operations. It is thought that the cost structure of the first year will also be operative in the second year.

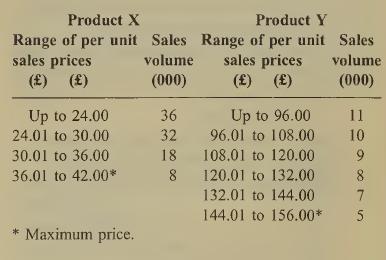

Both products are new and French is one of the first firms to produce them. Hence in the first year of operations the sales price can be set by French. In the second and subsequent years it is felt that the market for X and Y will have become more settled and French will largely conform to the competitive market prices that will become established. The sales manager has researched the first year’s market potential and has estimated sales volumes for various ranges of selling price. The details are:

The managing director of French wishes to ascer¬ tain the total production cost of X and Y as, he says, ‘Until we know the per unit cost of produc¬ tion we cannot properly determine the first year’s sales price. Price must always ensure that total cost is covered and there is an element of profit - therefore I feel that the price should be total cost plus 20%. The determination of cost is fairly simple as most costs are clearly attributable to either X or Y. The general factory overhead will probably be allocated to the products in accordance with some measure of usage of factory resources such as labour or machine hours. The choice between labour and machine hours is the only problem in determining the cost of each product - but the problem is minor and so, therefore, is the problem of pricing.’

Required:

(a) Produce statements showing the effect the cost allocation and pricing methods men¬ tioned by the managing director will have on (i) unit costs, (ii) closing stock values, and (iii) disclosed profit for the first year of operation.

(c. 8 marks)

(b) Briefly comment on the results in

(a) above and advise the managing director on the validity of using the per unit cost figures produced for pricing decisions,

(c. 4 marks)

(c) Provide appropriate statements to the manage¬ ment of French Ltd which will be of direct relevance in assisting the determination of the optimum prices of X and Y for the first year of operations. The statements should be designed to provide assistance in each of the following, separate, cases:

(i) year II demand will be below productive capacity;

(ii) year II demand will be substantially in excess of productive capacity.

In both cases the competitive market sales prices per unit for year II are expected to be X - £30 per unit Y - £130 per unit Clearly specify, and explain, your advice to French for each of the cases described. (Ignore taxation and the time value of money.)

(c. 8 marks) (Total 20 marks) ACCA P2 Management AccountingLO1

Step by Step Answer: