Advanced: Cash budget financial model The chief accountant of Gannet Ltd is interested in developing rudimentary financial

Question:

Advanced: Cash budget financial model The chief accountant of Gannet Ltd is interested in developing rudimentary financial models of aspects of the company's activities.

Among those ideas under consideration is the building of a simple cash budgeting model for use in forecasting the monthly cash flows from routine operations in any month.

Sales in the month of June 1979 were £100000; the gross profit margin earned was 33%% on cost of sales. It is confidently expected that the value of sales will increase by 1% per month for the foreseeable future.

20% of sales are made for cash, and the remainder on credit.

Of the cash due from credit sales customers it is expected that 20%

will be collected in the month after sale, 60% ln the second month after sale, and 20% in the third month after sale. No bad debts are expected.

All purchases of inventory for resale are paid for in full in the month after purchase. All inventory purchased in month tis sold in month t + 2. Similarly, all sales in month I+ 2 are made from inventory purchased in month I.

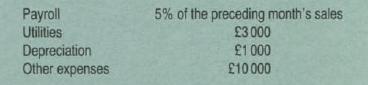

Monthly expenses (other than cost of sales) are expected to be as follows:

No expenses are accrued.

It has been decided that, at this stage, no other factors will be included in the model. The effects of dividends, taxation, capital expenditure, and any other matter not already specified, may therefore be ignored.

You are required to:

(a) set out in the form of equations a model of Gannet's cash flows arising in any month from normal trading activities, suitable for use as a formula for cash budgeting, (11 marks)

(b) apply your model to produce a statement of the relevant cash flows arising in September 1979, {7 marks)

{c) suggest how you could incorporate uncertainty into your model if the chief accountant's staff were uncertain about the rate of sales growth, the relative proportions of cash and credit sales, and the speed of payment by credit customers

Step by Step Answer: