Advanced: Comparison of NPV and IRA Two firms for which you act as financial consultant are seeking

Question:

Advanced: Comparison of NPV and IRA Two firms for which you act as financial consultant are seeking your advice concerning the appraisal of investment projects.

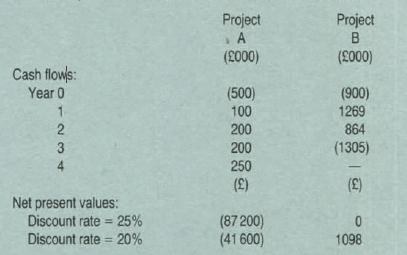

Firm Exe is considering 2 independent projects. Project 8 is unusual and if undertaken must be continued lor its whole life of 3 years; it cannot be terminated before year 3. The correctly calculated incremental after tax cash flows relating to each project, and the net present values calculated at two discount rates, are:

Note: Brackets indicate negative figures.

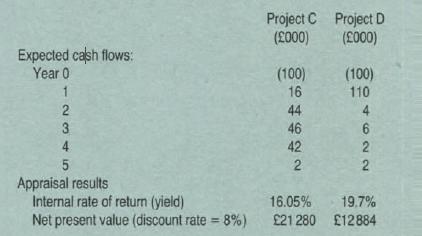

Firm Wye wishes to undertake one of two mutually exclusive projects. Both projects have risk characteristics which are identical to the firm's other assets. Details of the alternative projects are:

It is generally agreed that further investment opportunities available to Wye over the next decade are unlikely to promise a yield of more than Wye's cost of capital. Hence the current two proposals, each with a high promised yield, are the cause of much debate among Wye·s management team.

Wye's commercial manager feels that project C should be chosen as it has the highest net present value when the expected after tax cash flows are discounted at Wye's cost of capital of 8%.

The manag~ng director insists that project D must be chosen as its internal rate of return is higher; he claims 'a yield of nearly 20% on an investment of £100000 is clearly superior to a return of 16% on an identical outlay when both projects have equal lives' Wye's chairman feels that project D should be chosen as its payback period is shorter and the early cash flows can then be invested in other projects to earn a further return.

Required:

(a) Calculate the net present value of projects A and B at a discount rate of 15%. Using the results of your calculations together with the figures of net present value provided, estimate, to the nearest 1%, the internal rates of return relating to projects A and B. At hurdle rates of (i) 15%

(ii) 20%

indicate which of the two projects are acceptable using each of the two appraisal methods.

Clearly specify the range of hurdle rates for which project B is acceptable and comment on the reasons for this acceptable range. (8 marks)

(b) Explain the meaning of the 'net present value' and 'internal rate of return' measures. Outline the major comparative advantages and disadvantages of the two methods for the appraisal of independent projects. To what extent will the two methods give the same acceptlreject signals for independent projects? (8 marks)

(c) Explain why there is an inconsistency in the ranking of mutually exclusive projects C and D. show how that inconsistency can be resolved and advise Wye on which of the two projects should be undertaken. To what extent would Wye's cost of capital have to change before the choice of project would be altered?

Comment on the views of Wye's management team.

Step by Step Answer: